The stock markets have again borne the brunt of the communication war between Washington and Moscow. It is especially on the American side that the markets have been most affected. On Thursday, the Dow Jones experienced its worst session since November, with a drop of 1.8%. The S&P and Nasdaq fell by 2% and 3.9% respectively. The risk is not only a slowdown of the stock markets, but also a risk of volatility. In this respect, the VIX index, commonly known as the "fear index”--because it measures expectations of market volatility-- gained 15%.

This is not the first time in 2022 that geopolitics has added tension to the equity markets. On 24 January, for example, European stock markets experienced their worst day in a year and a half. "The markets are waking up to the Ukrainian problem, which seemed to be far away, but is less so today," Bruno Colmant, group head of private banking at Degroof Petercam, told Delano’s sister publication Paperjam the day after this first stock market debacle of the year.

The current downturn and risk of high volatility on the stock markets is taking place in a context where the American embassy in Kiev--currently moved to Lviv, close to the Polish border--accuses the Kremlin of having massed nearly 150,000 soldiers around Ukraine, 7,000 of whom have arrived in the last few days. Despite Moscow's recent declaration to recall some of its troops stationed on Ukraine's borders, the US embassy says it has seen "no evidence" of this. The embassy, now running on a skeleton crew, maintains that a Russian invasion "can happen anywhere in Ukraine at any time."

A game of political interests

At the same time, the US diplomatic service says it has identified disinformation campaigns and indications of "false flags". Without risking attributing responsibility to anyone in particular, State Department diplomats explain, for example, that a kindergarten was destroyed in Luhansk, in the Donbas region disputed by Moscow and in the hands of pro-Russian militias since 2014.

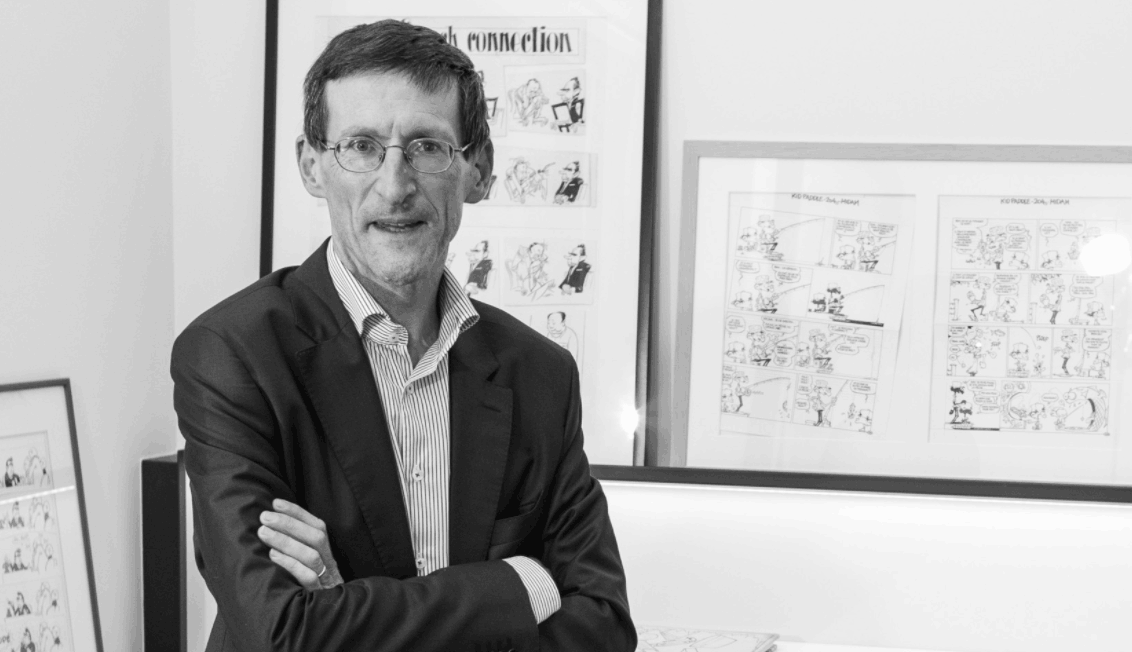

In such uncertain circumstances, analysts call for a certain serenity and do not hesitate to provide a rational analysis. This is notably the view of Callataÿ: "We are victims of particular ambitions on the part of both Mr Putin and Mr Biden, who see a political advantage in the tension."

Nobody has an interest in a conflict. Upstream of this, there is, in my opinion, a mistake that has been made by the West. It was to suggest to Ukraine that it could join Nato. We should have gone towards a scenario of regionalisation of Ukraine, a scenario where the Russians have access to Crimea for their military fleet in Sebastopol. That's what Henry Kissinger said before 2014.

In this sense, Callataÿ does not hesitate to put the current tensions into a critical perspective of recent history: "Nobody has an interest in a conflict. Upstream of this, there is, in my opinion, a mistake that was made by the West. It was to suggest to Ukraine that it could join Nato. We should have gone towards a scenario of regionalisation of Ukraine, a scenario where the Russians have access to Crimea for their military fleet in Sebastopol. That's what Henry Kissinger said before 2014."

Opportunities in the face of fear

On the macroeconomic level, Callataÿ invites us to put Ukraine's economic weight into perspective. "It's sad to say, but Ukraine weighs nothing on a global scale," he explains, adding: "What can have an impact on the world economy are inflationary pressures and an increase in interest rates."

So are we obscuring the real problem in the markets, which is inflationary fever? "This concealment has served Joe Biden's interests, since in the United States, in 2021, salaries have increased, but less than inflation," says Callataÿ. In the perspective of the American mid-term elections in 2022, this is not a favourable observation for the resident of the White House. The strategy is therefore simple: "Make people think about something other than this loss of purchasing power." In this way, Callataÿ believes that "the stock markets, by focusing on the noise of boots, have lost sight of what was their number one problem: the rise in interest rates.”

The stock markets, by focusing on the noise of boots, have lost sight of what was their number one problem: the rise in interest rates.

With such an analysis, the co-founder of Orcadia Asset Management therefore adopts a "contrarian" stance, i.e. a contrary logic on the markets. Referring to the saying "buy at the sound of the gun and sell at the sound of the bugle", Callataÿ encourages us to "go against the fears of financial players". This is akin to buying when the main trend is to sell. "Bad news on the Russian-Ukrainian front is for me a buying opportunity insofar as other people think it will get out of hand." In this frame of mind where "fear is a source of opportunity for those with cash", Callataÿ explains that he is buying the markets cheaper today than he did on 1 January even though "the profit outlook for companies is rather even better today".

This story was first published in French on . It has been translated and edited for Delano.