State Street’s investor confidence index rose to 95.8, up 6.1 points from May’s revised reading of 89.7. The European and North American indexes both increased--to 104.9 and 90.0 respectively--while Asian investor confidence dropped to 96.7.

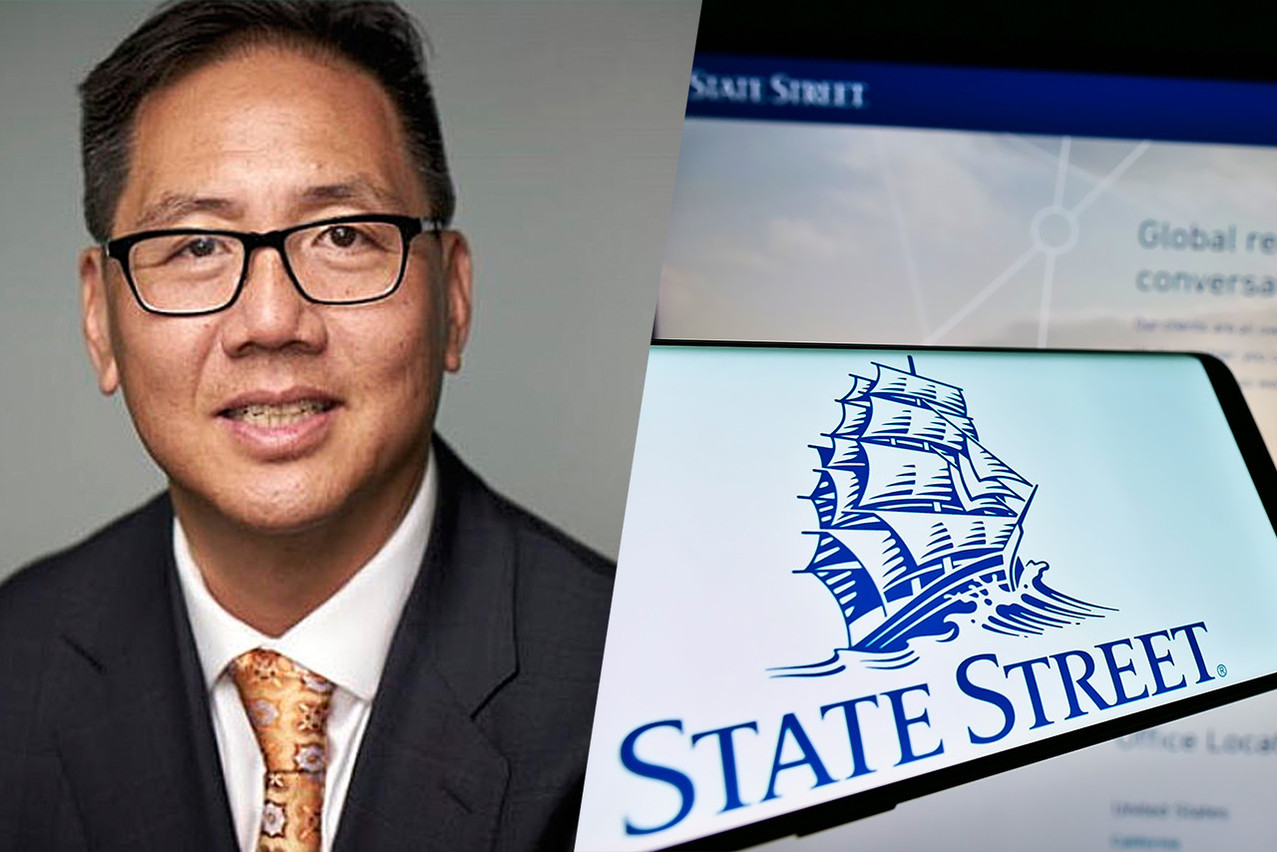

“Investor confidence was once again stronger in June, with the Global ICI improving for the sixth consecutive month, a streak that has only been replicated once (in 2009) in the 25 years since the creation of the index,” said Marvin Loh, senior global macro strategist at State Street Global Markets, in a published on 28 June. “While confidence has rallied smartly since the start of the year, it remains below neutral, signalling a continued defensiveness towards overall risk allocations.”

Investor confidence in Europe, on the other hand, now stands at 104.9, said State Street. It was the only region with an ICI reading over the neutral mark of 100. A neutral reading of 100 means that investors are neither decreasing nor increasing long-term allocations to risky assets, said State Street.

“The Europe ICI was also stronger on the month, returning to risk-seeking territory as it records the highest reading amongst the regions we track,” commented Loh. Investor confidence in North America also improved, with the debt ceiling debate resolution having “removed a significant market risk from the radar.”

State Street has $37.6trn assets under custody and/or administration and $3.6trn in assets under management as of 31 March 2023. It’s active in more than 100 geographic markets and employs around 43,000 people around the world, including approximately 1,000 in Luxembourg.