Schroders, a global investment management firm, announced the launch of a new global equity impact fund on Tuesday 20 February, in response to growing client demand for public equity-focused impact strategies. Developed in partnership with the socially responsible asset manager Blueorchard, the Schroder International Selection Fund (ISF) Global Equity Impact aims to adhere to the UN sustainable development goals under article 9. This initiative targets investments in companies that are tackling societal and environmental challenges, with a focus on critical areas like health and wellness, financial inclusion, sustainable infrastructure and responsible consumption and production, Schroders. Based in Luxembourg, the fund is designed to not only generate a positive societal impact but also provide attractive long-term returns to its investors.

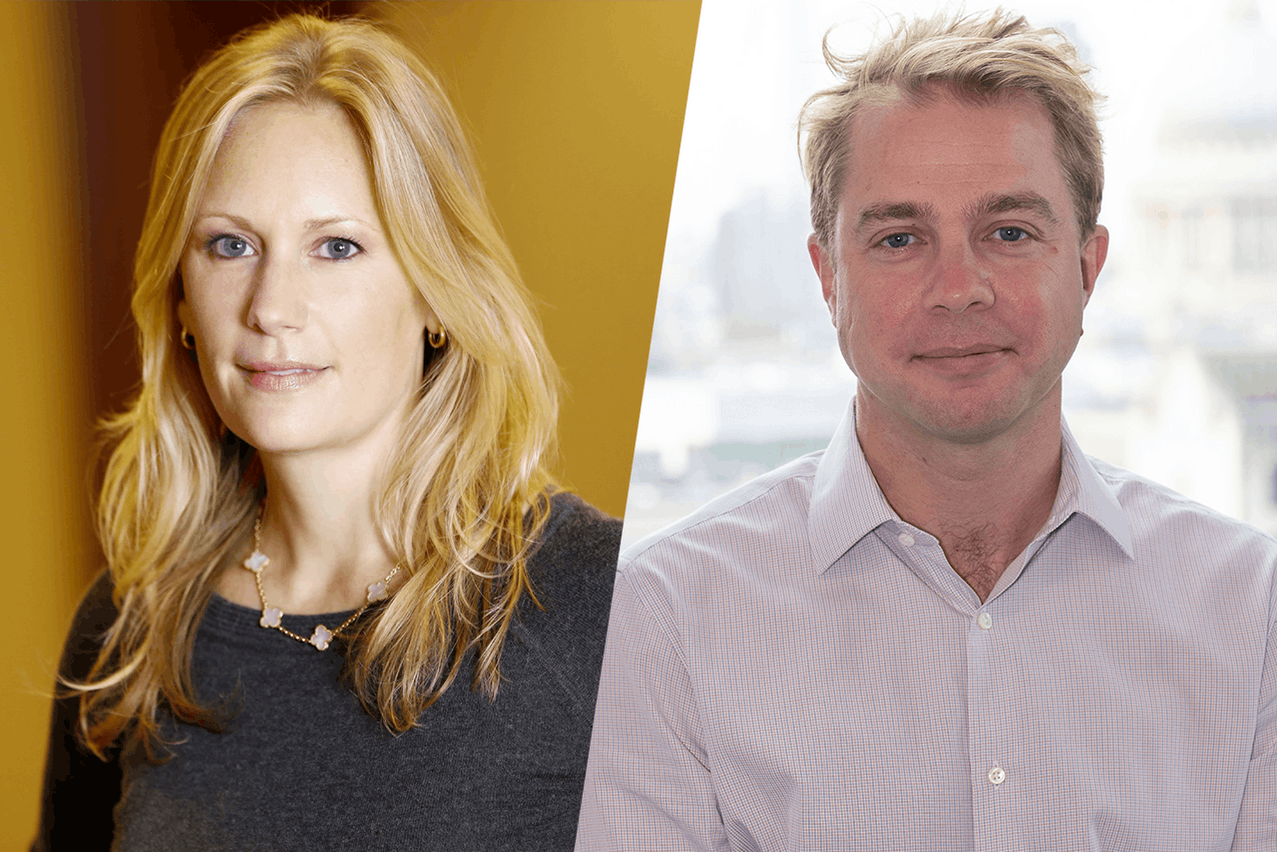

Jointly managed by Schroders’ US small and mid-cap team and the European equity specialist team, with Joanna Wald and Paul Griffin leading, the fund addresses the urgent need to tackle the extensive social and environmental issues highlighted by the UN SDGs. These challenges, the fund co-managers note, require solutions beyond the capacity of governments and NGOs alone.

Wald and Griffin also stressed the vital role of public markets in recognising and rewarding companies that deliver efficient and impactful solutions. By concentrating on companies with technological, scientific or market leadership crucial for impactful outcomes, the fund aims to be an active, long-term investor that both contributes to and enhances its impact over time.

As of 30 June 2023, Schroders reported assets under management of €846bn.