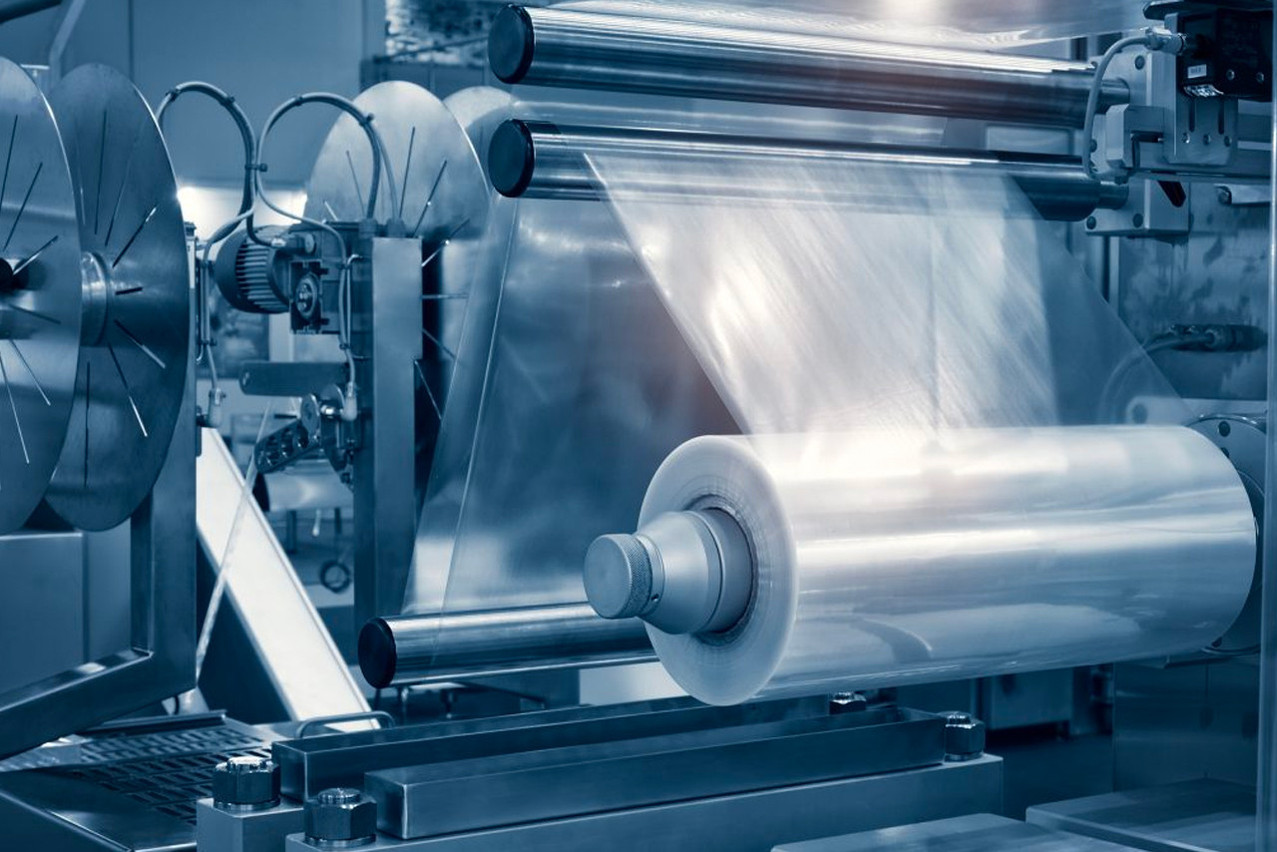

Mylar Specialty Films, which has been based in Contern since 1965, has just confirmed a redundancy plan affecting 95 of its 112 employees, due to a decline in competitiveness and significant financial losses. The production line will be closed over the next few months, affecting the production workforce and most current employees. Some commercial and support services will continue to operate within Mylar Specialty Films.

This is due to a drop in demand for plastic films and an increase in costs, particularly energy prices above historical averages, which have affected the company’s profitability. The company was also affected by “logistical tensions,” says its 2023 business report, and was unable to ensure a sufficient load rate for its production line.

“Due to its specialised capacity, the products and markets that this facility can profitably serve are fundamentally limited. In recent years, multiple factors have contributed to sustained financial losses for the facility. Despite considerable efforts by the company to mitigate the situation, operating costs have remained too high and external challenges have prevailed. Market conditions have not allowed the company to achieve sufficient volume to maintain a profitable business, and the overall outlook remains unfavourable,” said a recent company press release.

In 2023, the market in which it operates, PET (polyethylene terephthalate), experienced a sharp decline in Europe and the United States, with falling demand. While forecasts for 2024 were rather optimistic, competitive pressure and energy prices meant that losses could not be avoided.

In 2022, the company recorded a deficit of €44.9m despite sales of €170.7m. The following year, the company managed to reduce its deficit to -€10.9m, but also saw its sales fall to €102.7m. This delicate situation had already led to the closure of two production lines in 2023, followed by a job retention plan in view of the weak signs of market recovery.

The job retention plan had already led to a reduction in the workforce from 270 employees in 2022 to 133 by the end of 2023. The company had also decided to refocus its business on developing customer applications and marketing, and by 2023 had achieved a 100% delivery rate.

This article was originally published in .