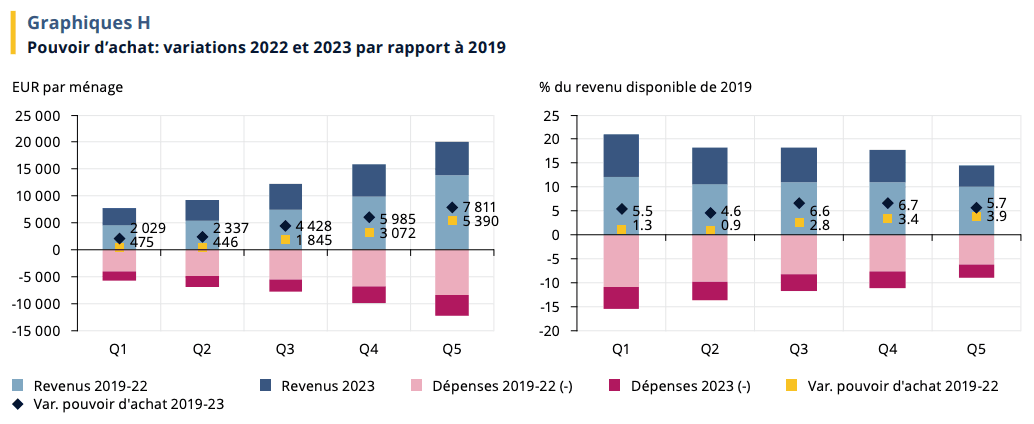

Between 2019 and 2023, the purchasing power of Luxembourg households increased, with average gains varying according to income quintile. The least well-off households (Q1) saw their purchasing power increase by an average of €2,000, while those in the top quintiles (Q5) recorded an average gain of €7,800. In relative terms, the middle quintiles (Q3 and Q4) enjoyed the biggest proportional increases.

However, these increases need to be qualified. Lower-income households spend a higher proportion of their income on energy and food, expenditure items that have been hit hard by inflation. So, despite an improvement in their nominal purchasing power, their financial room for manoeuvre remains limited.

Trends in purchasing power, Graph: Statec

Strong growth in spending

Between 2019 and 2023, household spending rose by almost 14%, driven by increases in energy (+35%) and food (+20%) prices. These increases have had a greater impact on lower-income households, who spend a larger proportion of their budgets on these items. For the most affluent households, although the increase in prices is noticeable, their disposable income enables them to maintain a certain level of financial comfort.

In addition, spending on services, particularly in the catering and tourism sectors, has risen sharply since the end of covid-19 restrictions. These items account for a considerable proportion of the budgets of affluent households, contributing to the gap in consumption levels between quintiles.

Forecasts: rebound expected in 2025

For 2024, Statec forecasts a slight fall in purchasing power, due to persistent inflation and rising electricity prices ). Low-income households will be hardest hit, as energy accounts for a large proportion of their total expenditure.

However, incomes should start to rise again from 2025, boosted by tax adjustments, notably the adjustment of tax scales, and the indexation of salaries. Purchasing power gains over the period 2019-2025 are expected to reach up to +8% for certain intermediate quintiles.

Uneven growth

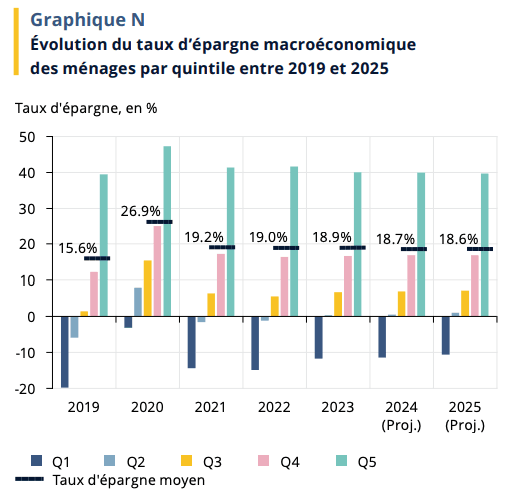

National savings are largely dominated by the most affluent households, which are able to put aside a significant proportion of their income. By contrast, modest households, faced with higher incompressible expenses, struggle to build up a financial reserve. This situation highlights structural disparities in income and financial behaviour. Targeted policies could strengthen social protection and improve access for low-income households to suitable savings products.

Savings of people in Luxembourg. Graph: Statec

Read the full study .

This article was originally published in .