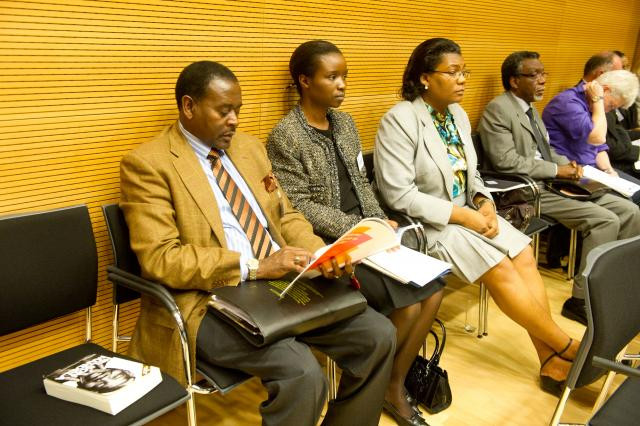

A lively but respectful debate about the prospects for doing business in Sub-Saharan Africa concluded the first South Africa in the African Continent seminar. The event, held on September 23 at the Chambre de Commerce, attracted more than 100 guests and several high profile analysts and experts with hands on experience of doing business in Africa.

The general mood at the confab was of cautious optimism, with speakers keen to point out the advantages currently held by many countries on the continent as they successfully pursue economic growth. Indeed, both the IMF and the World Bank have predicted growth in the area of between 5.3 and 5.8 percent for 2011 and according to The Economist in the first decade of this century, six of the world’s ten fastest-growing economies were in sub-Saharan Africa, while the IMF forecasts Africa will grab seven of the top ten places over the next five years.

Nevertheless, the speakers were not shy to acknowledge the problems still faced by Africa, including access to financing, corruption and the lack of infrastructure. Even South African ambassador Dr. Anil Sooklal admitted that education and security were not yet as good as they should be in his country, but that significant progress had been made to amend the situation that was a legacy of Apartheid.

Political instability, on the other hand, has dropped way down the list of negatives, and the example of free and fair elections with few instances of violence in Zambia last week was used to highlight the progress made on democracy. But, as John Cairns of Rand Merchant Bank, pointed out electricity is still a “key constraint” to successful business in many countries. Christoph Limmer of SES ASTRA also highlighted the logistical problems of in country roll-out of cable connectivity posed by geographical difficulties, which is why SES has seven satellites serving every country on the continent. The company recently approved an extra one billion dollar investment as it aims to help migration from analogue to digital television access throughout Sub-Saharan Africa. “This will give access to information from around the world.”

A challenge facing investors and anyone doing business with South Africa in particular is the Rand--the world’s most volatile currency, as Cairns put it. This is a problem faced by the likes of Nadine Pyter, who started her own Taste of Africa wine and food import business five years ago. The wine industry and other exporters have recently suffered because of the strong Rand, says Pyter. But her passion for South African produce, and especially her belief in the quality of its wines, continues to give Pyter confidence in her business model.

Jacques Elvinger, the South African Honorary Consul to Luxembourg and a member of the board of Alfi, said his industry’s biggest challenge in gaining a foothold in South Africa was the stringent conditions laid down by local regulators for funds aimed at retail investors. “In South Africa they are very conscious of investor protection,” he said. “Conditions go well beyond those at EU level.”

Nevertheless, John Cairns believes that the case for investing in Africa has been made by the strong growth forecasts. And, he pointed out that South Africa itself, and not China as many may believe, is the biggest investor in Africa.