1. Crypto assets as a new horizon

As the first and only Luxembourg AIFM authorized to manage AIFs investing in crypto assets, 6 Monks (6M) has integrated the specific features of this emerging asset class into its risk management function. The crypto asset market differs from traditional financial markets because of its sometimes high volatility, the nature of the assets traded (crypto-currencies, utility tokens, stablecoins, NFTs, etc.) and its accessibility (open 24/7). Against this backdrop, 6M's risk management function covers liquidity risk, which is a key focus from the regulators' point of view in order to ensure investor protection.

2. Overview of the crypto asset market

Crypto assets regularly experience periods of high volatility, with price fluctuations affecting systemically the crypto market. This instability is exacerbated by the use of leveraged derivatives, which can trigger cascading liquidations, but also market concentration due to crypto whales ( 0,004% wallets with more than 1,000 BTC representing 39% of the supply).

Crypto assets regularly experience periods of high volatility, with price fluctuations affecting systemically the crypto market.

Overall, the crypto asset market maintains its momentum following the rally in bitcoin and other crypto assets in 2023. The SEC's has approved spot ETFs in early 2024, and the halving of bitcoin occurred in April 2024. At the same time, the adoption of this new asset class continues, contributing to higher trading volumes.

In September 2024, the total capitalization of the cryptocurrency spot market reached $2,010 billion (74% of the market capitalization of the CAC 40 index), considering that bitcoin is one of the 10 most capitalized assets in the world with a capitalization of $1,250 billion. In addition, the total average daily volume of the cryptocurrency market in September 2024 was $64 billion.

3. Designing an appropriate liquidity model

Several factors have been taken into account in the design of the liquidity risk model:

1. Trading volumes, which are an indicator of the depth of the market, i.e. its ability to absorb large transactions;

2. The costs associated with transaction fees and the bid/ask spread, which indicate the liquidity or illiquidity of an asset;

3. Price impact, which assesses the resilience of the market and its ability to adjust to its initial value following imbalances in the order book.

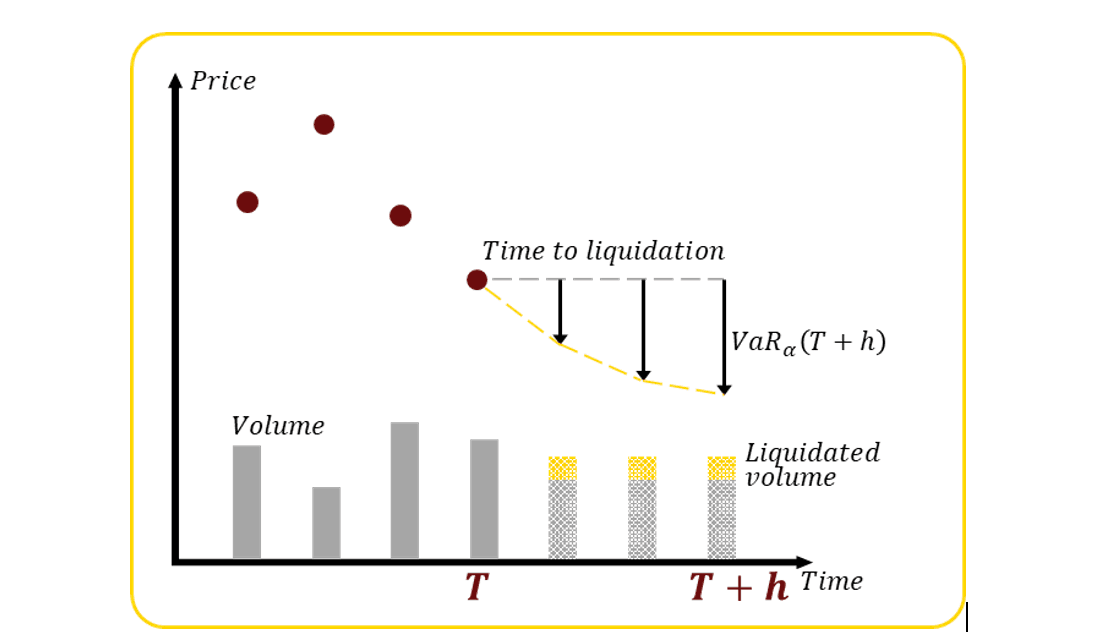

When modelling the liquidity risk of a crypto asset portfolio, 6M relies mainly on 2 factors which are (1) the Time to Liquidation and (2) the Value-at-Risk (VaR) of the crypto assets.

Illustrative data on prices, volumes and how order books are used to calculate a liquidation delay, project a VaR and estimate the volumes liquidated each day. (Photo: 6 Monks)

With regard to the method of liquidating a portfolio in the event of a liquidity crisis, the pro rata approach has been chosen because it allows a portion of the portfolio to be liquidated in proportion to the investments. The pro rata approach is often preferred to the waterfall approach because it preserves the asset allocation after liquidation, which does not alter the current investment strategy.

The liquidation period is calculated individually for each crypto asset, taking into account the fund's daily liquidation capacity (often expressed as a number of tokens). The daily liquidation amount is obtained by multiplying the daily volume according to the fund's access to the markets and its participation rate, the latter referring to the proportion of market liquidity assumed to be available under normal market conditions.

Liquidation Daily (Photo: 6 Monks)

As the participation rate is not an observable data, its estimation requires several assumptions in order to capture the liquidation costs as well as the impact on prices. Given the difficulty of establishing these assumptions for an asset class as nascent as crypto assets, 6M has chosen to calculate the daily liquidation amount from the order book of each pair traded on the trading platforms available to the AIF (observable and live data). The daily liquidation amount is then calculated based on a maximum price imbalance tolerance associated with the sum of the pending orders in the order book.

Once the liquidation period has been determined, the liquidity discount can be calculated by examining the volatility of each crypto asset. This is estimated using a daily VaR calculation and then extrapolated over the liquidation period. In the development of the VaR model, the Kolmogorov-Smirnov test showed that the daily log-returns of crypto assets do not follow a normal distribution. As a result, the VaR cannot be extrapolated by multiplying the daily VaR by the square root of time. After extensive analysis, 6M's risk management function has concluded that a fat-tailed distribution (i.e. a distribution where the number of observations is greater than the normal distribution in the area away from its central value) is required to model the daily log-returns with an appropriate time conversion formula.

Distribution of daily log-returns for the BTC-USD pair from 01/01/2021 to 30/09/2024. A fat-tailed distribution has been calibrated, with a p-value of 25.9% for the Kolmogorov-Smirnov test. (Photo: 6 Monks)

4. Challenges encountered

Modelling liquidity risk for an asset class as specific as crypto assets presents a number of challenges.

First, access to observable market data is paramount, as liquidity modelling requires accurate, granular and comprehensive data for each crypto asset and exchange platform. Using aggregated data is an attractive approach for a risk manager, but it would not reflect the fund's access to markets or its true liquidation capacity.

Modelling liquidity risk for an asset class as specific as crypto assets presents a number of challenges.

Second, historical data on the crypto asset market shows that it regularly experiences periods of intense stress, with complex interactions between trading volumes and order book depth. In this context, the implementation of backtesting and stress testing represent a real challenge for a risk management function. By way of illustration, the selection of the period to be observed as part of the implementation of a stress test is a crucial step. A trade-off must be found to ensure that the period(s) selected are representative of the market and sufficiently recent to be applicable to recently listed crypto assets.

Finally, the heterogeneity of crypto assets in terms of liquidity and the limited hindsight we have with this constantly evolving asset class means that we need to implement a methodology with a limited number of assumptions.

5. Conclusion

Although market practices in risk management dedicated to crypto assets are still not widespread, not to say non-existent, the liquidity risk modelling implemented by 6M demonstrates that it is possible to implement a robust and relevant risk management system for this new asset class, in line with regulatory requirements. However, taking into account the specificities of crypto assets require specific developments, expertise in this new asset class and an informed use of the scientific literature in order to accurately capture the various risk factors.

Alternative Investment Fund Managers in accordance with the the law of 12 July 2013 on fund managers

Alternative Investment Fund