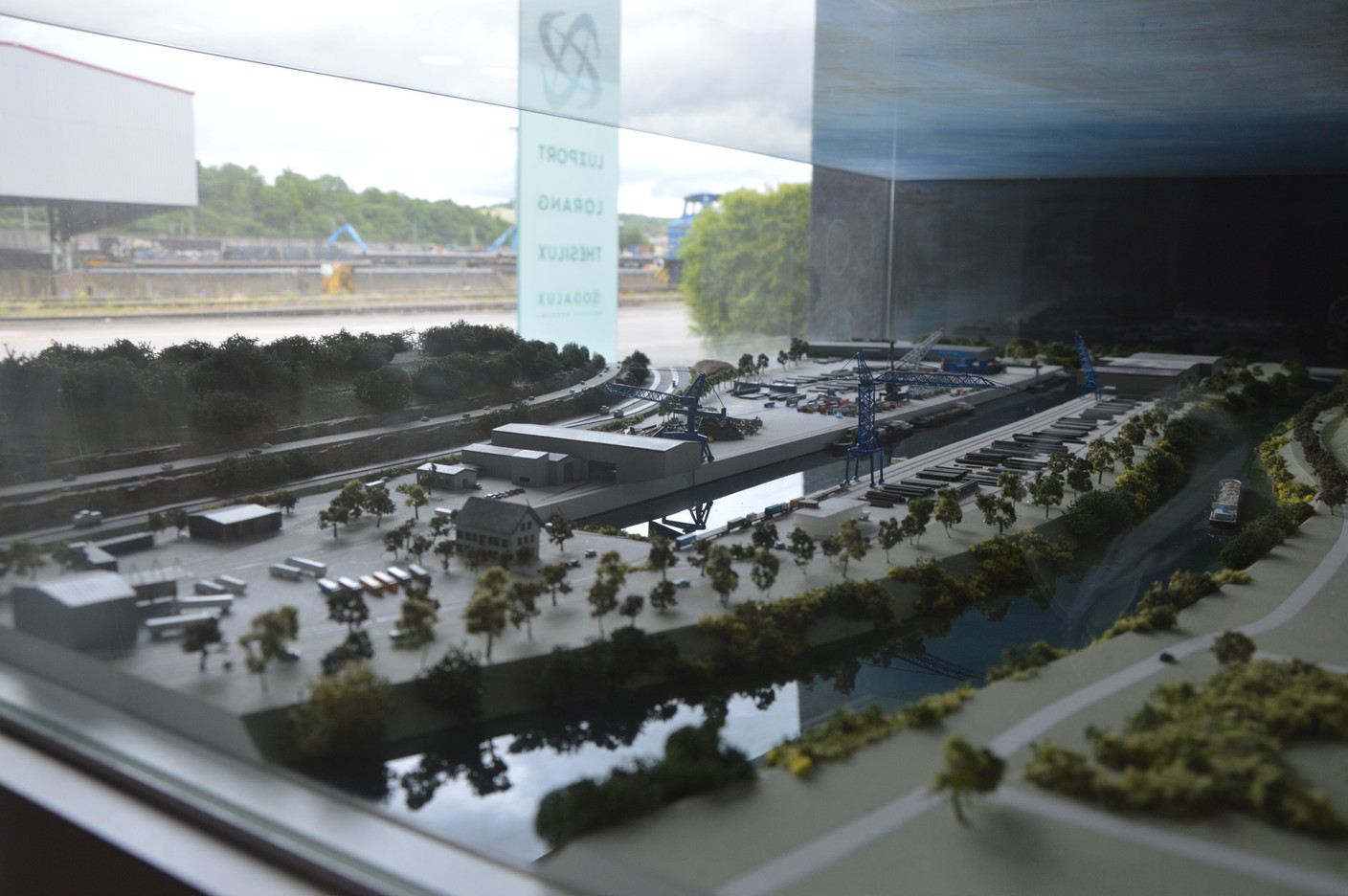

Early in the morning, the wagons arrive loaded, or to be loaded. All day long, a parade of lorries, barges and boats follows. Three companies are based here in the port of Mertert, which was opened after the Moselle was canalised in 1965. Tanklux, which specialises in storage and transhipment services for petroleum products; concrete supplier Bétons Feidt; and the Luxport group, “the main operator of the port site,” according to the Société du Port, which manages the infrastructure. Luxport was formed in 1992 from the merger of Manuport and Portlux.

Today, the Luxport group is a giant with--at least--three heads and with a turnover of €75m in 2023. It wasn’t always a giant, but it was one that quickly realised the importance of diversifying in order to survive. First, in 1997, with the acquisition of TCT (Trier Container Terminal) in Trier to position itself in the container business. Then, in 2006, Luxport’s port business was further expanded with the creation of Lorang, a road haulage company specialising in wide-gauge freight. This is the group’s second largest business, and the largest in terms of activity, accounting for almost 67% of the group’s turnover (€50m) in 2023. In 2009, a Lorang subsidiary, Lorang Gmbh, was set up in Germany, focusing on standard, secure transport.

In addition to the traditional transhipment of bulk goods such as sand, minerals, fertilisers, fuels and construction materials, Luxport specialises primarily in the handling of metal products (long steel, flat steel, scrap metal, etc.). It remains closely linked to the steel industry, and moved even closer to it in 2018 when the group created Thesilux, specialising in the treatment, sandblasting and coating of products such as sheet piling, beams, pontoons and all other steel elements. “We treat surfaces against corrosion, for example, but it all depends on the customer’s requirements, in terms of colour and length--from one metre to 40 metres,” explains , who took up his post in December 2023.

“Our vision is to offer the customer the best, most complete solution: unloading, welding, surface treatment, loading, transport using the most appropriate method and delivery. This is an advantage for the customer, who doesn’t need to organise himself with different partners. This is how we differentiate ourselves,” explains Braquet.

Trimodality, the key to its success

Braquet’s role is that of a captain, or rather an orchestra conductor, who has to set this trimodal system--at the heart of Luxport’s business--to music. “Trimodal transport means synchronising the different modes of transport. It means having a hand on all three, to offer the perfect solution for each customer, but also for the environment.” This way, the three modes of transport form a complete chain that can navigate even in troubled waters. Or in periods of low water, rather. “This year, we’ve tended to have high water. But we have had low-water periods in August, as in October and January. There aren’t really any rules any more. The Moselle doesn’t pose too many problems in this respect, because it’s channelled and the locks make it possible to control water levels. But it’s more of a problem with the Rhine. Every morning, our river activity manager checks the water levels. He also looks at the Danube. Trimodality is important here, because if we have a problem with one transport flow, we can turn to another. We can turn to another flow, and the customer will still be able to ship his equipment,” explains Braquet.

The group, which employs just over 300 people, has two barges on hire that operate at 100% capacity. In terms of shipments, Luxport ships 380 barges a year, 200 of which are steel barges. “When one is in Mertert, the other is in Antwerp, for example. So we go round and round between Antwerp, Bonn, Mertert and Metz, continuously,” explains the manager. Luxport handles 700,000 tonnes of transhipment a year, including 400,000 tonnes of steel, “which represents 60% of our business,” Braquet points out.

Everywhere on the Moselle

On the road, through Lorang, the Luxport group has a fleet of 120 lorries, with 170 trailers, some extendable to 33 metres and others specially designed for transporting steel. In 2023, Lorang carried out 73,700 transports, 45% of which were to Germany. One-quarter (25%) of its shipments were made here within Luxembourg, and the rest to the Benelux countries. “We can sometimes go as far as Rotterdam or Poland, on the Danube, or Romania if the customer has projects there. The whole chain remains under our control. We can also ship by rail, as far as Lyon,” Braquet says as an example. “Our customers are mainly in the region, but then they go all over the world. ArcelorMittal is one of our biggest customers, and we are long-term partners. As far back as the 1960s, Arbed was one of the companies most interested in building the port. They had the masses and the parts, so it always made sense to call on us,” he explains.

On the rail side, Luxport works in conjunction with the CFL. “We have 15,000 tonnes of containers a year. We sometimes transport them by railcar. In 2023, CFL acquired shares in Luxport. We have a very good partnership, and five rail lines leading to the port. They are used mainly for unloading steel, but also for containers,” explains Braquet.

On the water, to make this trimodality more efficient, Luxport wants to maintain loading capacity throughout the region. In 2018, the group set up MMS at the port of Metz, specialising in container activity. And having several other home ports along the Moselle is also a lever for sustainability. “If we want to think about our business in terms of the energy transition, then we need to have hubs. Because the ‘last miles’--the kilometres travelled by road--have to be as short as possible,” says Braquet.

Read also

For him, it is clear that the Moselle and river transport will play a key role in the energy transition. “We can transport very large masses in barges. Up to 3,000 tonnes, the equivalent of 150 lorries on the road. Barges will play a key role, particularly over long distances. Here we have the opportunity to be on an axis that takes us to Antwerp, Rotterdam and the whole of Europe. But we are also dependent on neighbouring countries on the Rhine. We’ll have to defend the Moselle and the Main,” Braquet predicts.

Luxport wants to think greener

On its own scale, Luxport is also thinking about its transition to a greener future. In January, an electric truck was added to Lorang’s fleet. “An electric truck involves completely different planning. You have to take into account the truck’s charge, the battery recharging points, the unloading of what you’re transporting, but also the topography and the seasons. We have good experience of this today, around factories or hubs, over short distances. But over long distances, we’re trying to think differently. We’re running tests with biodiesel. As for hydrogen, it’s still early days. Clearly there are financial risks involved, but we need to start testing that too,” Braquet explains.

For greener barges, things are a little more complicated. “You buy a barge for 30 to 50 years. If you buy a barge today, you need to be sure that it has the potential to switch to hydrogen or electric power tomorrow. We are carrying out a risk study on importing hydrogen to Mertert, which will be finalised shortly. As for electric barges, the problem is the counter-current. There is still the solution of biofuel, which could be used for a transitional period of ten years, for example. But it costs 30% more. In the years to come, we can imagine a multitude of interlocking solutions: electric for short distances, biofuel for longer distances, and hydrogen for very long distances on defined routes, but we need the corresponding infrastructure, which we don’t quite have today,” he says.

A challenge that goes hand in hand with that of the energy transition is that of digitalisation and automation. Let’s take the example of this new electric truck: unlike combustion-powered trucks, its planning has to be thought through differently, taking into account other constraints. “One of our pillars is digitalisation. For the past two years, we have been investing in new software, in particular truck planning software. It’s an important tool that’s becoming indispensable. Like AI, we’re starting to take an interest in it. It’s still a work in progress, but it could help optimise the use of lorries on the roads. We have also put in place a stock management solution. This minimises the risk of errors in orders. We started with scanners and a labelling system for each product, this year with steel bars. The other aspect of digitalisation concerns our KPIs, so that we can monitor our activities and react as quickly as possible,” says Braquet.

In 30 years’ time, here, I can see more barges in the port, although there will still be lorries and wagons.

Automation, on the other hand, is not so simple to put in place. “We have 35 welders, 40 handlers, crane operators, machinists and administrative staff. We still have a lot of manual tasks and we can’t automate everything. Some of the welding or administrative tasks could be automated, or other tasks such as weighing lorries or greeting drivers. But transhipment today is still difficult to automate because there is no standardised process; it can vary according to the size of the containers, their location…”

Luxport is sailing into the future at its own pace. “In the future, we’ll have to think even harder about synchronising the three modes of transport, or even four. In 30 years’ time, I can see more barges in the port, although there will still be lorries and wagons. Maybe one or the other will be automated. But I don’t think any of the three will disappear, and we’ll still need the agility and flexibility of the truck for those ‘last miles.’”

This article was originally published in .