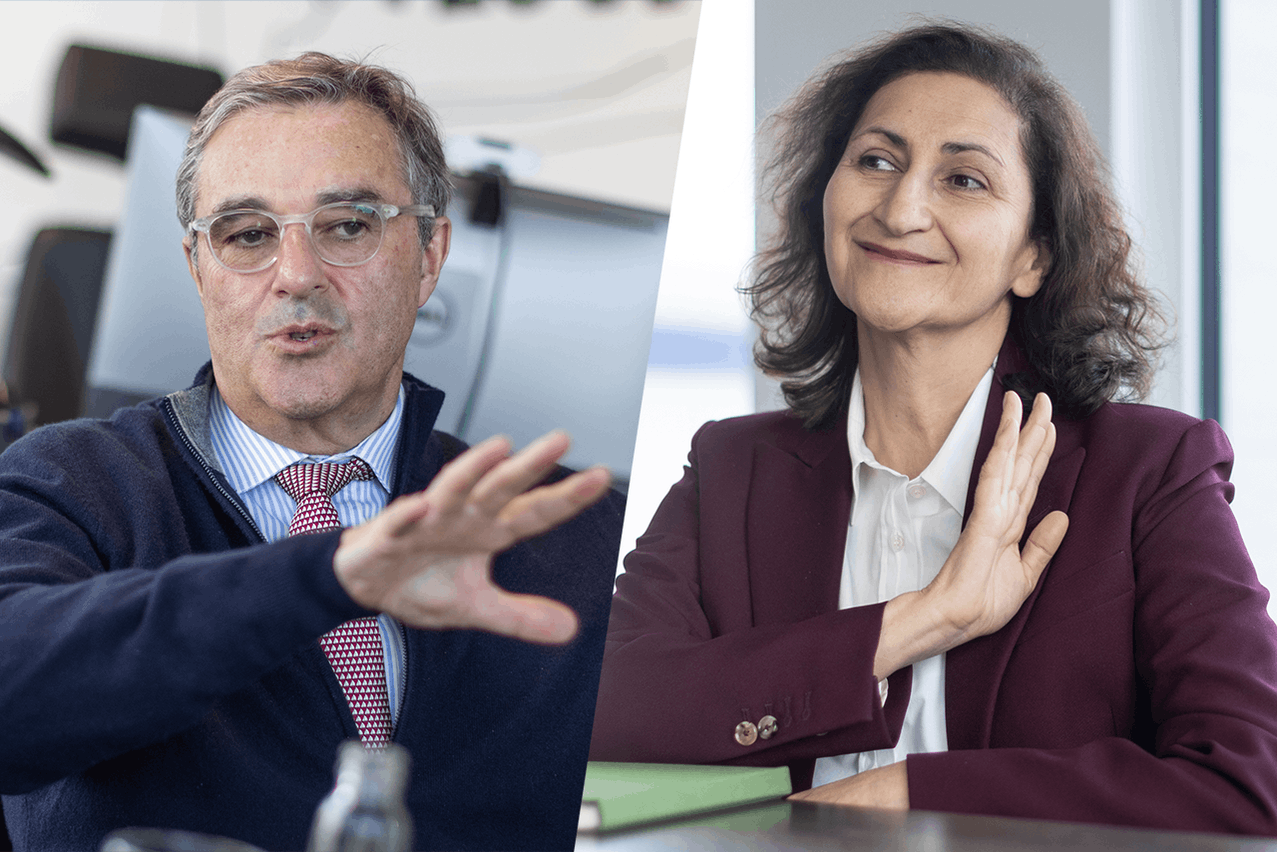

Carmignac announced on Thursday 28 March the retirement of Eric Helderlé, managing director of its Luxembourg entity and one the founding partners of the asset management group. Helderlé had been instrumental in the set-up of its subsidiary in Luxembourg, some 25 years ago. Last September, the firm announced that Rose Ouahba, managing director and former fixed income manager, based in Paris, will be responsible for overseeing the firm’s distribution and marketing efforts. The two have worked together on a handover in the last months.

A management committee of five persons largely based in Luxembourg has been established to ensure the transition. “I will remain an administrator of the group but not of the Luxembourg entity… and maintain a strong relationship with the management team,” Helderlé told Delano during an interview shortly before the firm’s formal announcement.

My job was to focus on distribution, marketing and the European expansion, whereas Edouard [Carmignac] was building up portfolio solutions

Helderlé explained that early on when setting up Carmignac with Edouard Carmignac in Paris back in 1989, a separation of activities was clearly instituted. “My job was to focus on distribution, marketing and the European expansion, whereas Edouard [Carmignac] was building up portfolio solutions.” He thinks that the portfolio management background of Ouahba will support a “convergence of both activities.”

Why open up a subsidiary in Luxembourg back in 1999?

Helderlé explained that the upcoming changes in Ucits regulation provided his entrepreneurial and still relatively small group a “European passport” to sell their products across the continent, which was further supported by the introduction of the euro.

The transfer agent ecosystem of Luxembourg was also decisive. He noted that Euroclear in France was “built to manage transactions and not positions.” The transfer agent in Luxembourg is an administrative entity that can maintain positions in addition to transactions.

Helderlé thinks that the efficient management of positions in Luxembourg enables his firm to remunerate his clients on their assets. “It was and it is still impossible to do that in France.” He considers such a “well-functioning logistic” as key to sell funds across Europe.

Greatest achievement and missed opportunities

“As in a supermarket, ensuring that our products were systematically on the shelves [of distributors] has been paramount to our success despite the initial lack of inflows,” said Helderlé. He noted that once the firm showed outperformance on the back of contrarian positions outside the market consensus, Carmignac managed to rapidly leverage its success which was translated into significant inflows. Today, its core market remains the retail distribution network through independent financial advisors.

Helderlé regrets not having penetrated the UK market as strongly and early enough as its other European markets. He thinks that this would have contributed to a much greater tailwind for his firm on the back of its investment high mark in 2008.