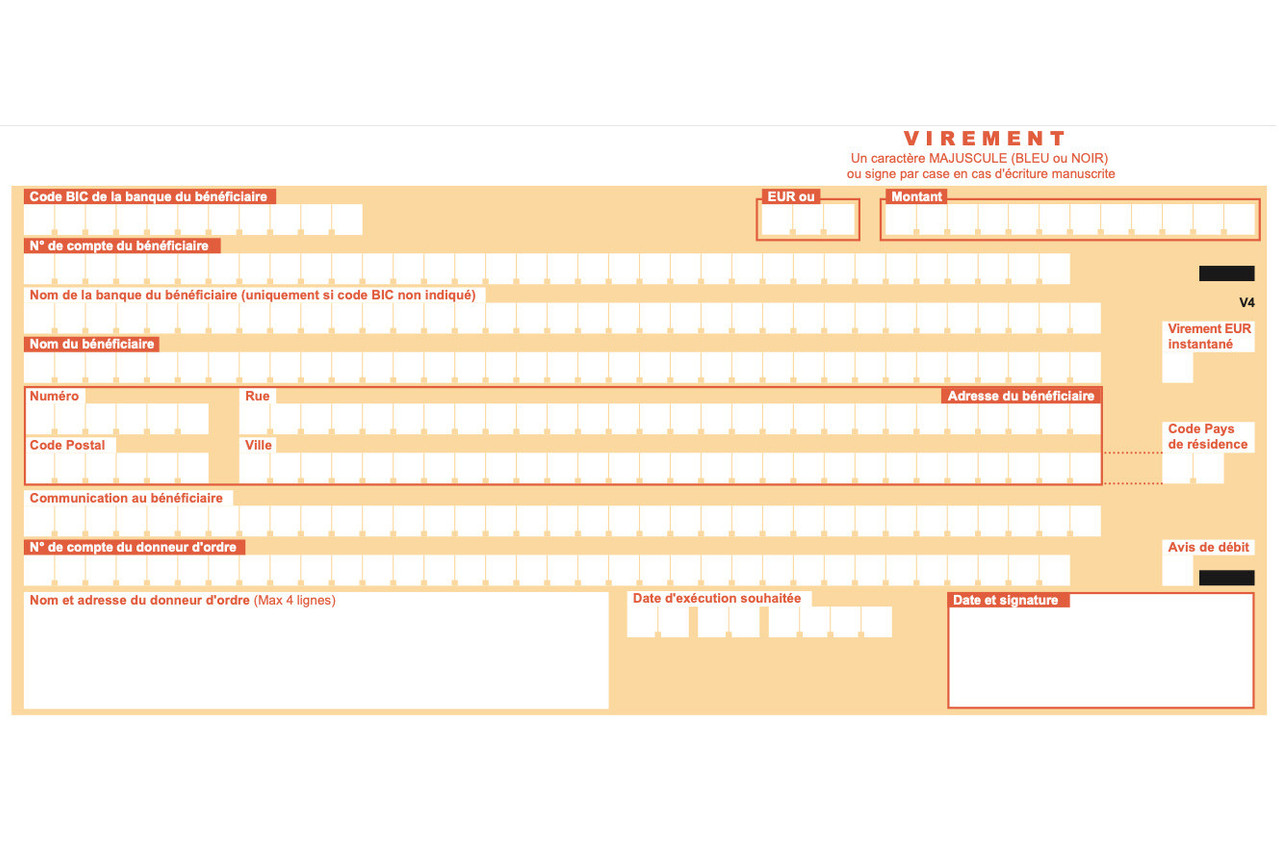

The Luxembourg Bankers’ Association (ABBL) has the introduction of an updated version of the universal payment slip (Tup) for banks and payment services, effective from 2 June 2025. The revision is designed to modernise the current system and improve the efficiency of Tup-based payments, which still account for approximately 1.2m transfer orders annually despite the growing dominance of digital banking methods.

The Tup has long been a staple in Luxembourg, particularly for individuals, companies and associations that rely on its simplicity. While the majority of transfers in Luxembourg are now conducted via cards, direct debits or digital credit transfers, the Tup remains popular due to its pre-filled data and user-friendly format, explains the ABBL. This is especially true for those who are less comfortable with online banking, as the Tup offers a straightforward method for processing payments.

In an effort to enhance the security and processing efficiency of Tup transactions, the ABBL, along with payment service providers and Victor Buck Services, has worked to update the payment slip. The new version, which will be ISO 20022-compliant, includes better-structured data, allowing for quicker and more secure processing of payments. This updated format is expected to provide both retail and corporate users with an improved experience.

A notable feature of the revised payment will be the option for users to request instant payment processing, starting on 9 October 2025. This new functionality will depend on the capabilities of the user's bank. It aims to provide greater flexibility in payment processing, particularly for urgent transactions.

The implementation of the new Tup format will occur in phases. From 2 June 2025, the new ISO 20022-compliant Tups will be introduced, running alongside the current formats. However, the short version will no longer be supported after this date. By 1 January 2026, the new payment format will be the only version accepted.

Retail clients will automatically receive the new Tups from their banks or payment service providers. However, corporate clients, public institutions and organisations are advised to either contact their printers or download the updated specifications and production guidelines from the ABBL website to ensure smooth adaptation to the new format.