The comments are in response to a recently published by Luxembourg’s financial regulator and central bank that asks financial sector players in Luxembourg how they are adopting AI.

The report’s own conclusion states that AI adoption among financial institutions in Luxembourg is “fairly limited” and “still at an early stage.” Only 32% of respondents in the survey said they had invested in AI or machine learning technology.

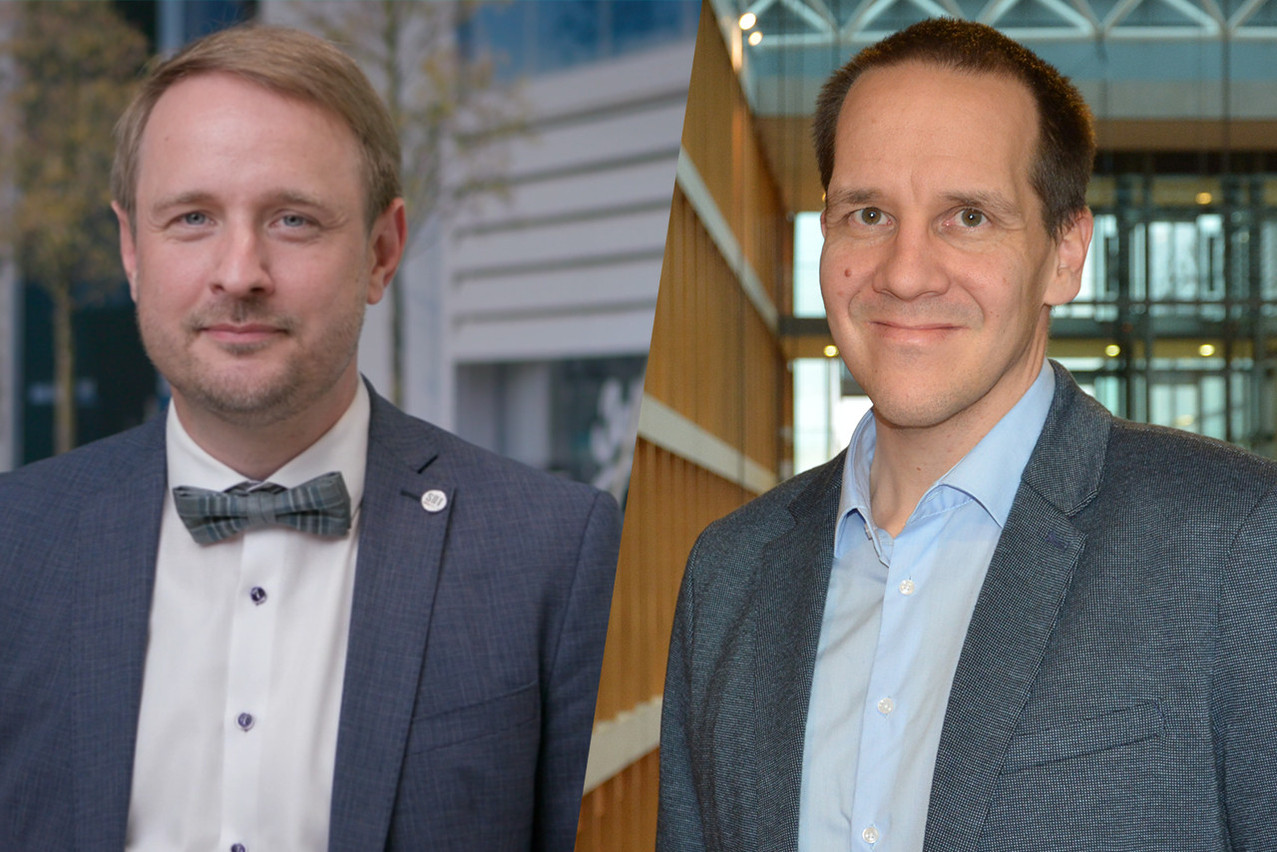

Dr Gilbert Fridgen, a professor and PayPal-FNR PEARL chair in digital financial services at the Interdisciplinary Center for Security, Reliability and Trust (SnT), said the survey results showed a lack of AI activity in Luxembourg’s financial sector. “The use cases being adopted are very standard. Based on the team sizes, upskilling and where the teams are located within the organisation, I'm not sure if the industry fully understands the disruptive nature of this technology,” he said.

According to the study, 138 respondents from banks and other financial institutions in Luxembourg participated in the survey, which was carried out between October 2021 and January 2022. Critically, generative AI tools now available to the public, such as Chat GPT, were not captured by the survey. Only 1% of survey respondents said they were interested in chat bots, suggesting views and perceptions relating to AI may have changed since the study was commissioned.

Notoriously slow to adopt technology

Fridgen said many financial firms were failing to fully harness the power of AI, preferring to adopt the technology in a limited scope, such as increasing process efficiencies.

The financial industry’s slow response to technological change reflects an unwillingness to adequately invest in IT and technology, according to Fridgen. “Over the past 20 years, the financial services industry has treated IT like electricity--something you need to operate, not something that can fundamentally change your business,” he said.

Fridgen warned that traditional financial institutions would continue to lose market share to nimbler fintechs and neo-banks, many of whom have embraced AI, if they don’t take the necessary steps to integrate AI technology into their business models.

Behind on AI compliance

Most respondents surveyed also reported not having specific AI related governance mechanisms in place, including an AI ethical policy (77%) and ethics committee (92%).

Dr Andreas Braun, director of artificial intelligence and data science at PwC, noted that while the data was now 15 months old, only a small percentage of companies surveyed had set up compliance processes around AI, warning that financial institutions might not be sufficiently ready for new EU regulations on AI. “Maybe there is not full awareness but given that the financial sector is a very compliance-driven industry it was still a bit surprising to see the lack of a refined strategy or process when this regulation might soon become reality,” Braun said.

The Artificial Intelligence Act is an EU legislative proposal to regulate AI based on its potential to cause harm. A cornerstone of the Act is a classification system that determines the level of risk an AI technology poses. High risk AI systems are permitted but must undergo rigourous tests and checks. Companies that do not comply with the proposed law once it passes could face heavy fines. The AI Act is currently under review in the European Parliament and is expected to be voted into law later this year.

Braun said that although Luxembourg was generally well positioned to apply the new rules, financial institutions needed more guidance in areas like bias detection, where the research showed compliance gaps exist. Only 22% of respondents in the survey reported implementing bias detection techniques. “I think something could be done to prime the financial sector and make sure there’s guidance to facilitate this future compliance process,” he added.

Data quality the biggest challenge

Data quality was reported as the biggest challenges among financial institutions surveyed. Only 29% of respondents claimed to have processes, policies and procedures specific for AI data governance and quality in place. Fridgen said poor data quality could prove to be a serious obstacle for firms that have previously neglected their data and now want to adopt AI technology.

Another problem is that many AI solutions are not standardised, requiring most financial institutions to develop their own AI tools. The survey showed that 73% of use case solutions using AI were developed in-house. Fridgen said with no off-the-shelf solution, in most cases, firms would need to tailor solutions to their specific data infrastructure and systems.