Invesco has introduced three new thematic exchange-traded funds (ETFs) designed to give investors targeted access to long-term trends in artificial intelligence (AI), cybersecurity and defence. The announcement was made on Monday 4 November 2024. Each of the ETFs will track innovative global benchmarks created by Kensho, a specialist unit of S&P Global Indices that focuses on the application of AI and next-generation technologies.

The new ETFs are domiciled in Luxembourg and will focus on specific areas of technological growth. The Invesco artificial intelligence enablers Ucits ETF will target companies involved in the development and enabling of technologies, infrastructure and services driving the growth of AI. The Invesco cybersecurity Ucits ETF will concentrate on companies working to protect enterprises and devices from unauthorised access through electronic means. Meanwhile, the Invesco defence innovation Ucits ETF will focus on companies engaged in the development of advanced weapons, defensive systems and solutions aimed at securing borders.

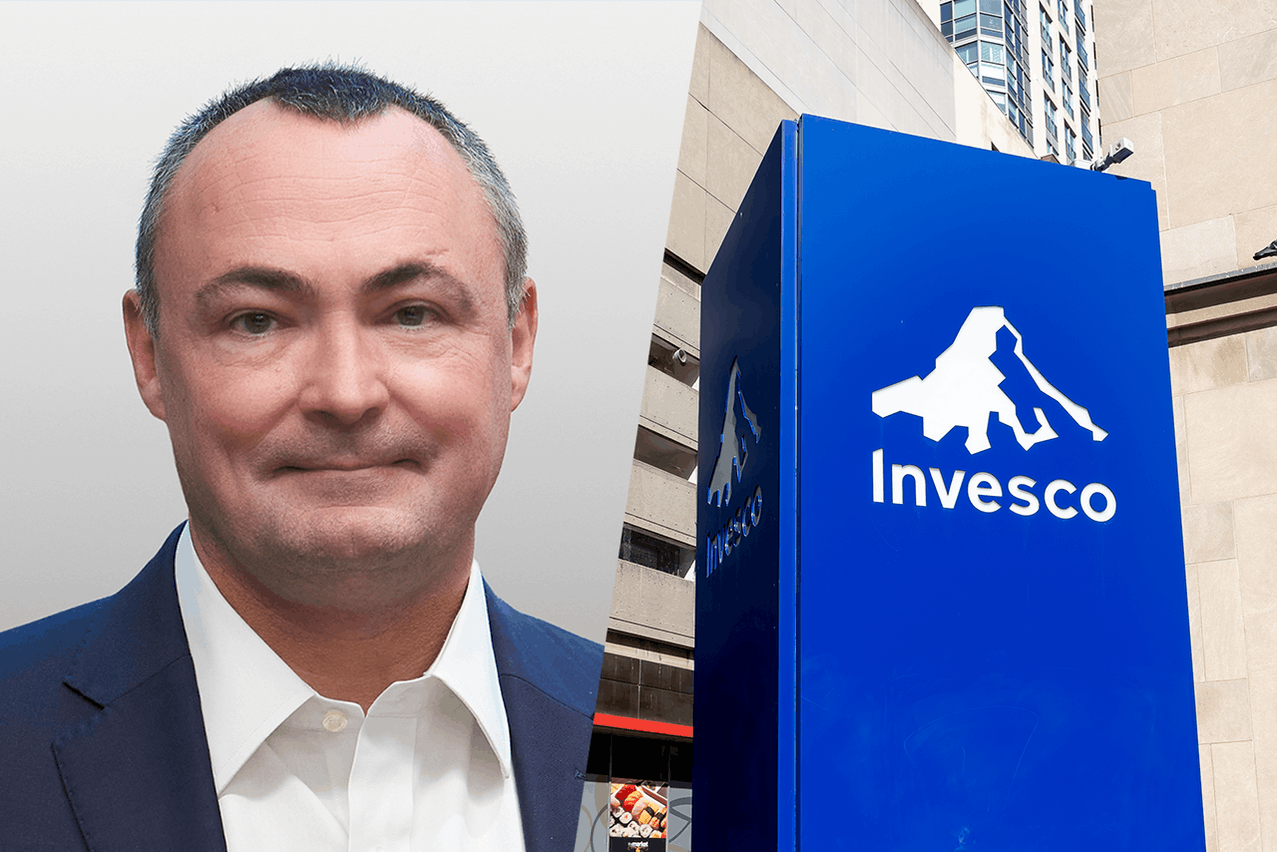

According to Gary Buxton, head of Europe, Middle East and Africa, as well as Asia-Pacific ETFs at Invesco, the rise of AI has captured widespread attention, but cybersecurity and defence solutions are also gaining traction as global threats evolve. Buxton highlighted that the partnership with Kensho was a strategic choice, given the firm’s expertise in applying AI and understanding rapidly evolving technologies. He further noted that Kensho’s connection with S&P Global Indices would offer investors a higher level of confidence in the administration of the ETFs.

The indices for the AI enablers and cybersecurity themes incorporate environmental, social and governance (ESG) screens. These filters exclude companies involved in controversial business activities, those that do not comply with the principles of the United Nations global compact or those with ESG scores ranking in the bottom 10% of the S&P Global BMI Index.

Chris Mellor, head of EMEA ETF equity product management at Invesco, outlined the key differentiators of the new ETFs. He emphasised that, at an annual charge of 0.35%, the ETFs offer some of the lowest management fees in their category. He also highlighted the expertise of the index provider, Kensho, and the focus of the ETFs on companies most directly aligned with the themes in question.