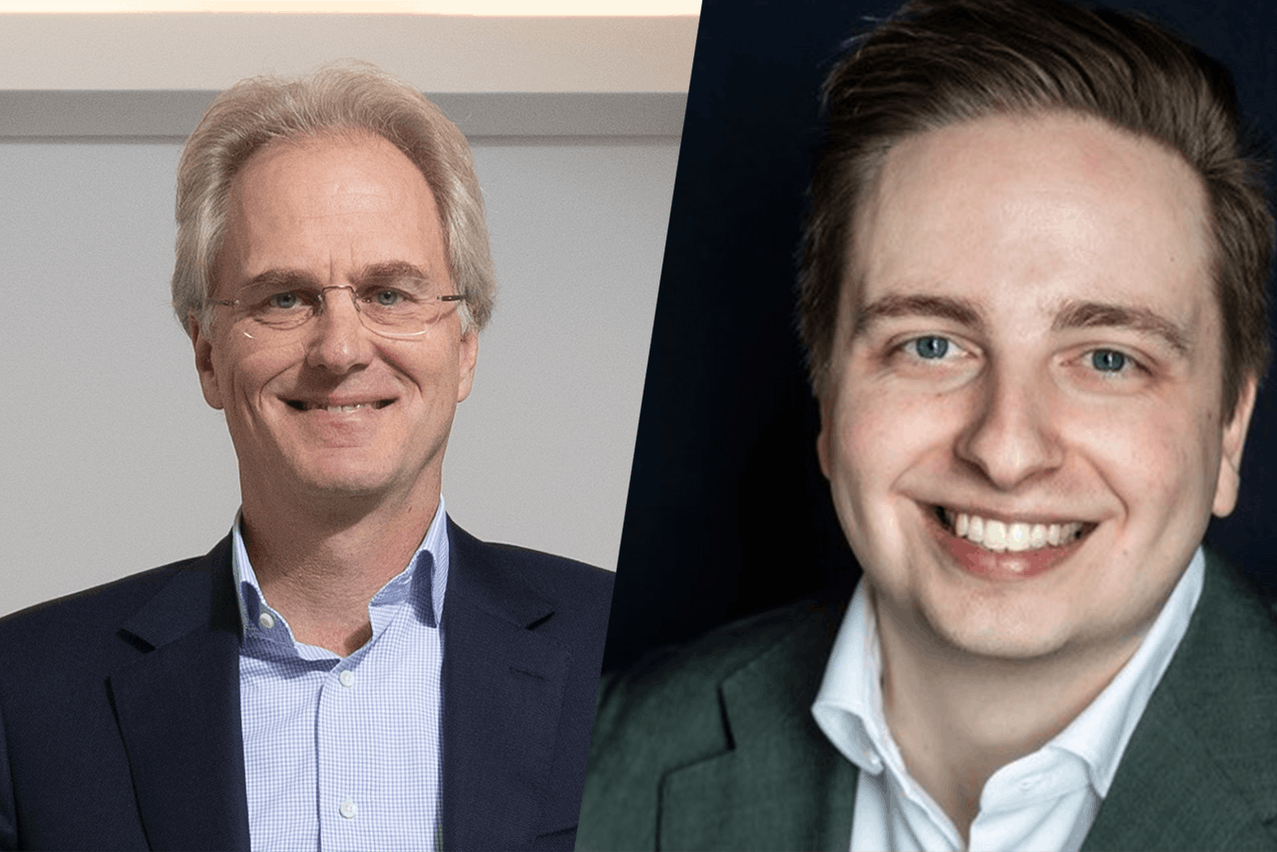

“When buying shares of Luxempart, you [indirectly] get a portfolio of illiquid assets… managed by us in Luxembourg… and in funds non-accessible to retail investors that we think are the best funds around,” said John Penning, managing director at Luxempart (LXMPR). Moreover, he claimed that owning shares of LXMPR provides “some liquidity on the stock while paying a dividend.”

Penning stressed that LXMPR has paid a dividend every year over the last 35 years with an average yearly growth of around 10%. The current dividend yields 2.9% (€2.17 per share) at the current stock price of €75.50.

Liquidity: “Our strength is also our weakness”

Penning commented that 75% of LXMPR’s shareholders are very stable and loyal. When approaching companies, he thinks that it is a strength to claim that LXMPR relies on “permanent capital, not an investment fund.” As a large portion of the shares belong to indirectly or directly to families, there is little trading activity, a weakness when it comes to trading statistics on volume and bid-ask spreads. “We don’t really have a market maker on the stock.”

Penning declined to comment whether the investment firm was actively taking actions to increase the share of retail investors in its shareholding profile by tempting them away from Eltif products. Yet, he thinks that it is very difficult for retail investors to get into high quality private equity funds given the ticket size in the “several million euros.” He suggested that GPs have a keener interest to deal with professionals as “you stay illiquid for a long time, minimally ten years.”

Illiquidity in the stock may continue

Joren Van Aken, equity research analyst at DegroofPetercam, diagnosed several ailments to explain the liquidity at Luxempart which is “among the lowest in the investment company [sector].” In addition to the “very low” free float, he blamed the listing on the Luxembourg Stock Exchange, which he considers an “outdated exchange… most stocks listed there are dead stocks.”

“Even if investors want to buy Luxempart, they often can’t”

Van Aken observed that large companies such as Brederode, ArcelorMittal and SGS have secondary listings in Brussels, Amsterdam or Paris, while the volume on the LuxSE is “typically less than 1% of the volume on the secondary listing.” He thinks Luxempart is the only big Luxembourg company that does not have a secondary listing.

None of the existing family shareholders seem to be willing to sell

As a sign of the challenges facing investors, Van Aken reported that Luxempart is not visible on either Google Finance or Yahoo Finance which “are arguably the two most used finance tools for retail investors” and “less than 50% of brokers” offer access to the LuxSE. Your correspondent confirms that Luxempart is not available for trading on Interactive Brokers, the number one stockbroker for Europeans in 2024, according to .

Without a larger free float, Van Aken admitted that a secondary listing may not solve the issue. “None of the existing family shareholders seem to be willing to sell.” Moreover, he thinks that the large cash pile does not bode well for an equity raise.

In a written communication, Guy Weymeschkirch, head of markets and surveillance at the LuxSE, noted: “The Luxembourg Stock Exchange is known as a leading listing venue, but we have implemented various initiatives that have helped increase the number of trades in recent years. By leveraging Luxembourg’s efficient financial infrastructure and engaging with committed intermediaries from Luxembourg’s broader financial sector, we are striving to establish a stronger trading environment and create a robust local ecosystem that will help Luxembourg flourish on the trading front.”

Persistent discount in valuation for investment firms

To the best of Delano’s knowledge, Luxempart is not covered by any broker-dealer in the market apart from (DP), which has been “commissioned,” i.e. its research is paid for by Luxempart. “We sponsor the research, but it does not mean that it is not independent,” stressed Penning. DP noted in its that LXMPR displayed an implied discount of 45% against 20% for other investment firms. After the recent stock rally, the discount remains at around 35%.

“These investment holdings [such as LXMPR] have always exhibited discounts [compared to their net asset value],” said Penning. He noted that the historical average of the discount for LXMPR over the last 25 years has stuck between 30% and 35%.

Penning thinks that the discount depends on the stock liquidity, portfolio profile, management transparency, size of the investment firm, trust in the valuation of the underlying assets, evolution of the dividend and size of the float (24% as of FY23). As the NAV growth over the last “ten to twenty years is among the best in the sector,” Van Aken concluded that the high discount on the stock is “mostly related to the low liquidity.”

Performance measurement: market looking for more transparency

Having tracked the company since 2021, Van Aken commented that the assets of Luxempart have “performed very well in recent years… especially in the funds segment.” Penning thinks that an appropriate benchmark to measure the performance of LXMPR at the corporate level is the “MSCI mid cap Europe net return,” a choice confirmed by Van Aken “due to the lack of better alternative.”

LXMPR does not disclose the underlying performance of individual assets. Its direct investments (pillar 1) delivered a +8.9% performance in 2023. Van Aken is unclear on the NAV growth contribution of Foyer Assurance (31% owned by LXMPR) given that lack of disclosure. However, he noted that Foyer “has paid significant dividends to Luxempart... in recent years.” Yet he wished LXMPR could provide “more information about its key metrics and its long-term strategy.”

On pillar 2, Luxempart’s private funds went up 11.6%, a “very impressive” result given that performance of “most of its peers… such as Brederode and Sofina… went down,” according to Van Aken. Penning considers that the funds performed “fairly well” and Delano understands that upcoming positive exits may further boost performance as LXMPR “receives in average its first proceeds after six to eight years after the first drawdowns…so what we received over the last years is the result of investment in 2015-2016.”

Whether it is for direct or indirect investments, Penning has not provided any benchmarks or absolute target levels.