(Ahead of the organised by the Paperjam Business Club on Tuesday 19 November at Kinepolis Kirchberg, we decided to give the floor to the players of the financial centre. This morning, Gilbert Fridgen, professor and holder of the Paypal-FNR Pearl chair in digital financial services at the Interdisciplinary Centre for Security, Reliability and Trust (SNT) at the University of Luxembourg, shares his thoughts with us.)

Guillaume Meyer: Professor Fridgen, do you view Luxembourg as a leader in financial innovation?

: Honestly, calling Luxembourg a forefront leader in innovation might be stretching it. What sets Luxembourg apart is a collective mindset towards innovation among all stakeholders. There’s a unanimous understanding of its necessity for national progress. Luxembourg can uniquely bridge its tech and financial sectors due to its compact ecosystem, unlike larger countries where these sectors are often separated, such as in the US with New York and Silicon Valley.

Looking forward to 2035, how do you see the European financial sector evolving?

Europe has always had robust regulations, and while sometimes seen as a hindrance to innovation, these regulations also foster a more sustainable and society-focused development. Discussions with US colleagues have highlighted that while the US may innovate faster, Europe excels at refining and improving these innovations to better meet societal needs.

This is evident in various sectors. Take the automotive sector, for instance--it’s quite similar. Tesla may have been the first to succeed with electric vehicles, but in the long run, we might again end up building better cars in Europe. The same principle could apply to financial services. Fintech has expanded rapidly, as has the technology sector in the US and China, but here in Europe, with the aid of regulation, we could develop solutions that better align with societal interests--particularly those of European society, such as protecting privacy.

What specific changes do you foresee for Luxembourg’s financial centre by 2035?

The essential nature of the financial services industry is the processing of information, much like other industries process physical materials. The future I envisage for Luxembourg involves a significant shift from finance-focused expertise to a more tech-centric approach. This transformation will likely lead to more interdisciplinary collaboration, balancing financial acumen with technological expertise, which I believe is crucial for the industry’s evolution.

By 2035, how much do you expect finance professions to have evolved?

Interdisciplinarity will be crucial. Being solely a finance expert won’t suffice; understanding technology will also become necessary. It’s not about becoming a programmer, but about being skilled enough in IT to recognise both the opportunities and limitations of technology.

The future will demand a blend of finance, technology and people skills

Additionally, the human element remains vital. Despite automation, personal interactions, such as discussing a mortgage, demand a highly skilled and trustworthy financial advisor. Therefore, the future will demand a blend of finance, technology and people skills.

What skills should finance professionals focus on to stay competitive in this tech-driven environment?

The key skill is interdisciplinarity, as I said, particularly tech knowledge within strategic decision-making layers of organisations. Financial institutions must ensure tech skills are well-represented at the top levels, including their boards. To stay competitive, attracting top-tier tech talent to Luxembourg will be essential.

How can financial institutions in Luxembourg prepare for these impending technological changes?

The best would be to collaborate with us! I coordinate the FutureFinTech National Centre of Excellence in Research at the University of Luxembourg. This combines expertise from our Interdisciplinary Centre for Security, Reliability and Trust (SnT) and the Faculty of Law, Economics and Finance. By partnering with the finance and tech sectors, we address current industry challenges with cutting edge research. We also offer up-to-date training and education, producing graduates who are well-prepared for careers in finance, equipped with both advanced degrees and practical, interdisciplinary skills. This is how we aim to support the financial sector’s adaptation to technological advances.

Which sectors within Luxembourg-based financial companies will be least impacted by digital transformation?

Wealth management is likely to be the least impacted. It’s inherently analytical but highly personalised in terms of individual portfolios, and heavily reliant on trust and personal relationships--elements that technology cannot replace. In retail banking and insurance, though automation has advanced, the scope for transformative change has somewhat plateaued. Existing retail banks have already begun adapting to a highly automated, lean model.

Will physical bank branches still exist in 2035?

By 2035, digital literacy will be considerably higher, reducing the general reliance on physical branches, especially among newer generations who are accustomed to digital interfaces like smartphones and computers. In addition, banking might evolve to include interfaces such as chatbots for routine transactions--imagine instructing a digital assistant to manage your banking tasks. Despite these advances, there will still be a need for physical branches for significant life events and more complex financial advice. The role of branches will likely shift from transactional support to financial education and advising on significant investments, like purchasing a home or planning for education expenses.

How significant do you think the impact of digital transformation will be on investment funds?

The area where I anticipate the most transformation is the fund industry. In my view, there remains significant potential for automating processes through various technologies, particularly the use of digital assets. Distributed ledger technology (DLT) may play a role, but I believe artificial intelligence will be more impactful, particularly in automating the document-based processes that are prevalent in this industry. There’s considerable untapped potential here.

I also think this industry remains somewhat closed off--distant from where typical startups would operate. For example, if you look at retail banking, young entrepreneurs might venture into it because they can identify, as customers, where change is needed. In contrast, the fund industry is more insular. It’s a world unto itself, perhaps resistant to change. However, once companies start investing heavily in innovations that make operations more efficient and cost-effective, change could happen very quickly.

What developments should we anticipate in this field?

I believe the concept of tokenisation, for instance, creating digital assets, doesn’t necessarily introduce new products into the market but rather offers a new technology that could enhance efficiency by reducing the costs associated with asset creation or transfer. This is the primary advantage of the technology.

Wouldn’t it make more sense to create tailored funds or investment portfolios that meet individual customer requirements?

You might ask, will it cause significant change? Yes, it could. For example, it enables finer granularity in distribution. If it becomes cheaper to transfer or create a digital asset, you might do so for smaller amounts, which could open up new opportunities. Consider what could be introduced to the market initially--it could become easier to trade smaller assets or incorporate them into portfolios. It also presents the possibility of creating tailor-made funds.

What do you mean by that?

When you examine today’s fund industry, there’s an overwhelming array of products available, which complicates the decision-making process for consumers. What is the added value of continuously creating slightly different products, making it difficult for people to choose the right one? Wouldn’t it make more sense to create tailored funds or investment portfolios that meet individual customer requirements?

For example, why do I buy a fund today? I might purchase an ETF because I want exposure to the Dow Jones Index, S&P 500 or MSCI World. But what if I want to invest in the MSCI World Index without supporting companies involved in fossil fuels or tobacco production? I could create a bespoke MSCI World fund without these elements, based on my personal values. And if I only want to invest €100, I wouldn’t need to buy a full stock--I could buy fractions, say 0.2 of one stock and 0.5 of another, to create a portfolio that aligns with my preferences. In this case, I wouldn’t need traditional investment funds. This idea might sound revolutionary, but from a technological standpoint, it’s entirely feasible, and I expect it will eventually enter the market.

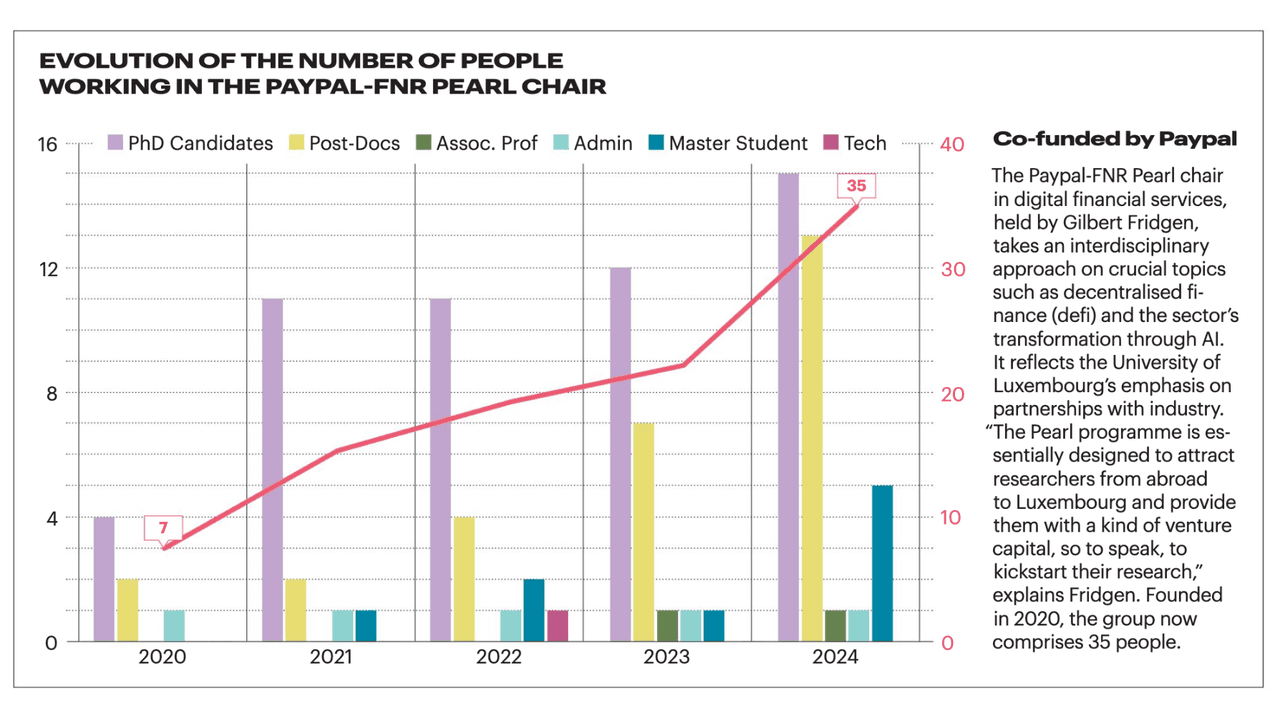

The Paypal-FNR Pearl Chair in Digital Financial Services, led by Gilbert Fridgen, takes an interdisciplinary approach to crucial topics such as decentralised finance (defi) and the transformation of the sector via AI. Image: SNT

It seems like we are still far from that reality…

Yes, the industry is currently structured in a completely different manner, but the same was true when we still used film for photography, or when we rented videos from a video rental store instead of streaming them. Significant change is possible in the fund industry, which is why I believe it’s better to have tech experts in Luxembourg developing these systems rather than clinging to outdated structures from the past.

You mentioned DLT earlier (a digital technology for recording asset transactions, where transaction details are recorded in multiple locations at the same time). Do you believe DLT could replace current financial infrastructures by 2035?

No, I don’t see DLT fully replacing existing financial infrastructures. Current systems largely function well, and the benefits of DLT may not necessitate a complete overhaul. However, DLT could improve efficiency in certain back-office processes and might render some traditional roles obsolete. While DLT offers possibilities like fractional ownership of digital assets, these could also be achieved with centralised systems. The main challenge lies in governance; getting multiple stakeholders, especially competitors, to agree on the structure and maintenance of these technologies is complex.

How do you see the adoption of DLT by financial players in Luxembourg, especially for managing securities and digital assets?

The financial sector in Luxembourg is prudently exploring DLT. It’s vital to understand and prepare for how these technologies might shape the future, without succumbing to hype. Past experiences have shown that rushing towards new technologies without a sound strategic approach can lead to pitfalls. A measured, informed exploration of DLT is preferable.

What are the main use cases and opportunities for Luxembourg with DLT?

The most promising application for DLT in Luxembourg could be in the fund industry, specifically around digital assets. Enabling investments in digital assets and transitioning towards such a model could position Luxembourg advantageously in the fund sector. DLT’s transparency and security features align well with the demands of modern financial transactions, particularly in asset management.

By 2035, can we expect widespread adoption of digital currencies?

Predicting consumer adoption of a digital euro is challenging. The European Central Bank’s primary motivation for introducing a digital euro is to achieve a certain degree of sovereignty from non-European payment systems. However, for consumers to prefer a digital euro over existing options like Paypal, clear advantages must be demonstrated. Privacy could be a compelling advantage if the ECB implements strong privacy measures to prevent payment data from being used for profiling by payment providers.

Read also

The acceptance of the digital euro by merchants and its value to consumers are still uncertain factors. Initially, we might see more adoption in wholesale central bank digital currencies (CBDCs) for interbank transactions, rather than retail use.

How could the implementation of a CBDC change banking infrastructure and payment management in Luxembourg?

On the business side, CBDCs could simplify and automate monetary exchanges between institutions. However, they will need to prove their efficiency and benefits over existing systems.

Could Luxembourg be a pioneer in the adoption of digital currencies?

I don’t believe any single country has a strategic advantage in adopting a particular currency. In the end, currency is simply a means of exchanging value, and there are already multiple ways to do this today. I don’t see much in the way of viable business models emerging from it. If Luxembourg aspires to be a pioneer, it would likely be through the adoption of AI and distributed ledger technologies to automate and streamline existing processes, or ideally, to create entirely new business models and innovative approaches within the investment industry.

What is the case for AI?

AI presents significant potential for automating processes within the financial industry, yet it also poses considerable challenges, particularly at the intersection of AI and regulation.

I believe technology is essential for competitiveness.

Where AI could truly excel is in handling and processing documents. Generative AI models, like those used in ChatGPT, demonstrate how efficiently AI can manage text-heavy tasks, which are prevalent in the financial sector.

Is Luxembourg’s financial centre well-positioned to leverage AI?

Currently, no industry is truly well-positioned in the realm of AI due to the rapid pace of technological advancements and regulatory complexities. For the financial services industry, there’s still considerable ambiguity around how and where AI can be used, which limits innovation potential. This situation is compounded by strict regulatory environments that do not fully accommodate the unique characteristics and challenges of AI technologies.

What are the regulatory challenges associated with AI in finance?

The primary issue is the expectation of perfection from AI, which is not realistic. Humans are allowed to make errors with certain oversight, such as the four-eyes principle, but similar tolerance isn’t extended to AI. Regulations often hold AI to higher standards of accuracy and impartiality than humans, demanding proof that AI systems are free from biases like discrimination, which is a difficult standard to meet. This discrepancy between the expectations placed on human versus AI performance highlights a significant regulatory challenge that needs addressing to fully integrate AI in financial services.

Read also

How can Luxembourg be at the forefront of innovation by 2035, particularly in terms of regulatory frameworks?

Regulation is crucial. It must be innovation-friendly yet robust enough to prevent trust-damaging practices. For example, the crypto industry shows how lenient regulation can lead initially to innovation but later harm reputational trust, as seen with companies like FTX in the Bahamas. Luxembourg must balance fostering innovation with stringent oversight, involving a strong dialogue between regulators, the tech and financial industries, and academia to understand and adapt to emerging technologies effectively.

The key word these days is competitiveness. Are we overestimating the contribution of technology to improving the competitiveness of the financial sector?

No, I believe technology is essential for competitiveness. It enables significant efficiency gains and can disrupt existing business models to create new ones. Although this might lead to a reduced need for traditional jobs in finance, the focus should be on upskilling workers to handle new technologies or to enhance their interpersonal skills for roles like financial advising. Technology should be viewed as an enabler that allows individuals to focus more on what they are best at.

Considering the current flat productivity curve in Europe, how can Luxembourg enhance its standing?

The flat productivity trend in Europe is concerning and likely stems from lagging behind in technological innovation, particularly compared to the US and China. To boost productivity, Europe, and by extension, Luxembourg, needs to invest heavily in technology and embrace the digital transformation that is reshaping industries globally.

What is your final take on the future of technology in Luxembourg’s financial sector?

All these technologies must be considered in tandem. It’s not about changes being driven solely by DLT, AI or digital identities, but rather how these innovations work together. For example, individuals or organisations will be easily identifiable through modern cryptographic algorithms. Transactions could become highly efficient using a form of DLT, and the entire process could be managed seamlessly, including interactions with external parties, the generation of reports and documents, and more, especially with the help of AI and large language models.

This will likely lead to a second wave of digital transformation. I’m quite certain of that. Companies that have already digitalised many of their processes will be able to achieve significant efficiency gains by adopting the next generation of technologies. However, those who have yet to undergo digital transformation, or those lagging behind, could face serious challenges.

Gilbert Fridgen’s research focuses on the transformative effects of digital technologies, particularly digital identities, distributed ledgers, artificial intelligence and the internet of things, in relation to IT strategy and regulatory compliance. He will speak at the 10x6 event titled “Luxembourg Finance 2035” on Tuesday 19 November at 18:30 at Kinepolis Kirchberg. Photo: Guy Wolff/Maison Moderne

How does Gilles Roth see the financial hub in 2035?

“I believe that Luxembourg’s financial centre will continue to be a key driver of the economy in 2035, anchored by sustainability, digitalisation and global connectivity,” said finance minister (CSV). “Ten years may seem short, but we believe our core pillars--banking, asset management, insurance, capital markets and fintech--will remain strong, complemented by the rise of new startups and more dealmaking in Luxembourg. As we climb the value chain, investment management will be essential in financing the green and digital transitions, supporting innovation at every stage.”

“Cosmopolitan and outward-facing, Luxembourg is perfectly positioned to connect global investors with European growth opportunities, acting as a driver for investments underpinning the competitiveness of the EU as a whole. Gender equality and inclusivity will be deeply woven into our financial fabric, ensuring finance is a force for positive, sustainable change. Luxembourg will not just keep pace with global financial hubs--it will lead the way, ensuring Europe’s future is open, resilient, and ready for the challenges ahead.”

How does Serge Weyland see the financial hub in 2035?

“By 2035, I expect to see substantial changes in the way financial products are distributed, driven by generational change and the fast pace of digitalisation across the value chain,” said , CEO of the Association of the Luxembourg Fund Industry (Alfi). “Tokenisation and the development of digital solutions like wallets will play a key role in creating more direct and cost-effective distribution models, allowing clients to access products without exclusively relying on traditional banking infrastructure. Luxembourg’s financial hub is well positioned to keep advancing up the value chain, especially through the growth of private assets. AI will enable us to automate time-consuming processes, like document analysis, allowing professionals to focus on more valuable tasks.”

“A critical challenge over the coming years will be engaging households to invest their savings in capital markets. By 2035, I am convinced that the EU will have made progress in this area, enhancing the fund industry’s role and impact on the broader economic and social fabric of Europe.”

How does Tom Théobald see the financial hub in 2035?

“I envision an even more diversified and specialised financial centre, with high value-added activities taking precedence over those that can be automated or outsourced,” said , CEO of Luxembourg for Finance. “Luxembourg will remain a key centre of expertise for major international groups wishing to expand their operations within the EU. A more competitive, digital and resilient EU will bring new opportunities for the financial sector and Luxembourg. Sustainable investments will become the norm, and new types of funds – such as tokenised funds, which represent an innovative distribution model--will be more sought after. In both areas, Luxembourg’s financial centre can play a leading role.”

“In an increasingly interconnected world, Luxembourg must strengthen its position as the gateway to the EU, establishing itself among emerging countries that, as they develop, will increasingly need to look beyond their domestic or regional markets. We need to connect with them in the medium term, to be ready when they are.”

This article was written for the , published on October 23. The content of the magazine is produced exclusively for the magazine. It is published on the site to contribute to the complete Paperjam archive. .

Is your company a member of the Paperjam Business Club? You can request a free subscription delivered directly to your home or office. Let us know via