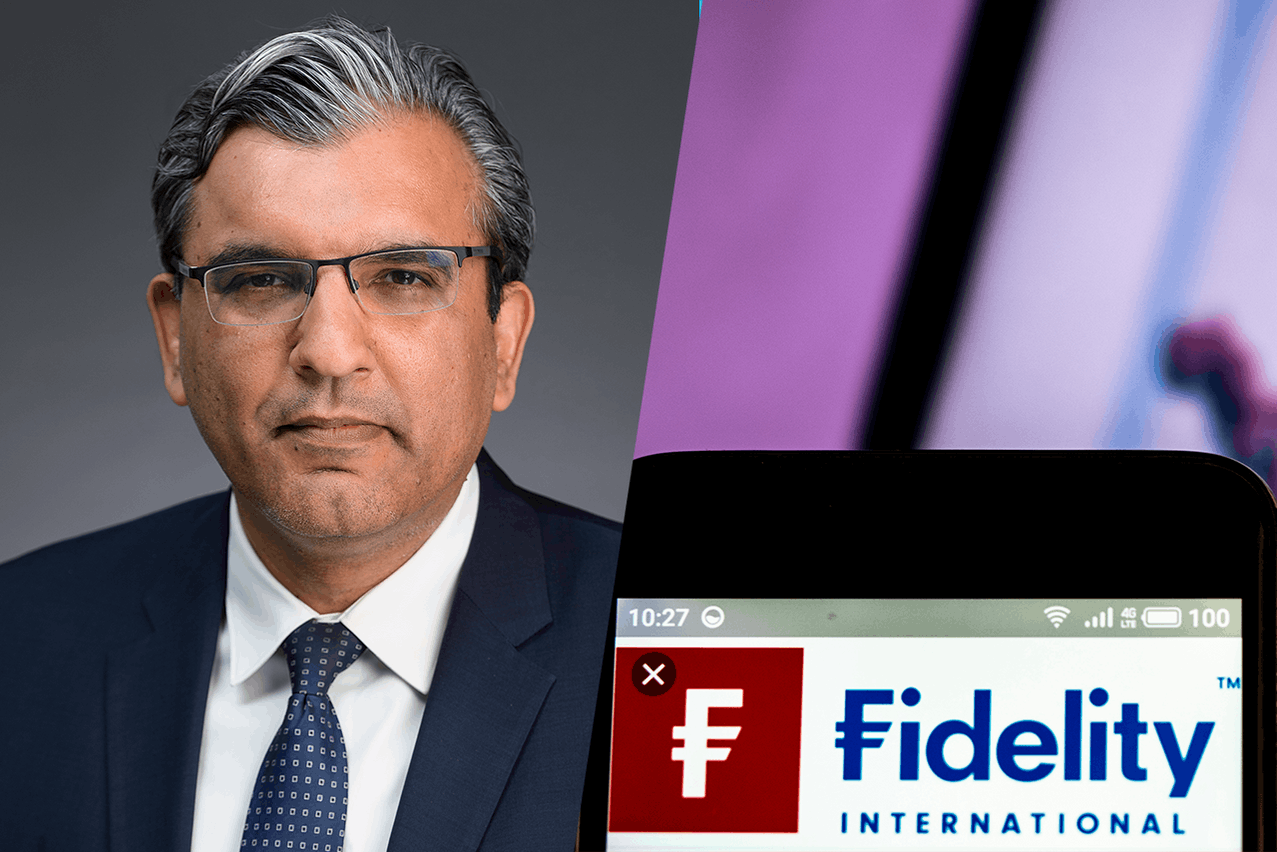

“Coming off two years of 20%+ returns in [US] equities… if you look at additional return analysis… you do get mean reversions of some sort,” warned Salman Ahmed, global head of macro & strategic asset allocation at Fidelity International during a presentation in Luxembourg on 21 January 2025. Ahmed felt compelled to make the comment given that 66% of the audience said during an electronic poll that it expects US growth to outperform other economic blocs while the “big winner” in terms of asset class will be equity (65%). Yet he added: “US [growth] did pick up quite significantly going into the end of the year.”

Return of stagflation

The base case at Fidelity is that real growth and inflation will pick up in 2025 on the back of strong US consumer spending. Ahmed is concerned that a “more aggressive” immigration policy shift from the US and/or a more “significant trade war” will result into . That being said, no recession is in sight.

This is reflected in the weakening of the “Future Activity Trackers” as opposed to the “Current Activity Trackers,” which has started to decline. He also noted that the world uncertainty index is also picking up.

Ahmed pointed out that 10 of Donald Trump’s 26 new executive orders--issued during the first days of his term--concerned immigration, focusing on “reducing the supply of new flow or migration to the US.”

The risk here is that financial conditions catch up with this uncertainty

On tariffs, Ahmed set apart the driving reasons for applying them against China and Europe (main economic adversaries), whereas their implementation against Canada and Mexico “have more to do with the border.” As such, Ahmed sees tariffs as a means for the US to negotiate border management with its immediate neighbours, whereas tariffs affecting China and Europe would be a “way to decouple” economically. Moreover, Ahmed will stay attentive to the speed and sequencing of tariff implementations.

In a separate discussion with Paperjam, Ahmed suggested that tariffs are also a means to force Canada to increase its military spending. The country, however, exports “a lot of energy” to the US. “Tump will never tariff energy.”

“So the risk here is that financial conditions catch up with this uncertainty,” stated Ahmed.

More hawkish than the market on the Fed

“When the market was saying four cuts, we were saying one cut.” Fidelity no longer expects a rate cut this year and “you may start thinking about hikes if the inflation shock is severe,” said Ahmed.

Europe: stagnant but with some signs of hope

“On European activity, there's not a lot to write home about,” stated Ahmed. According to Fidelity’s graphs, both activity trackers (current and future) are pointing downward. “Nothing positive may happen in Europe, but this thing can’t get worse, right?”

“The main support we are getting in Europe right now is through the ECB,” argued Ahmed who also thinks that the European Central Bank will cut rates aggressively. The ECB will not be concerned by a weaker currency as “it is the only way to punish the US.” He added: “trade wars are connected to currency wars.”

He thinks that aggressive immigration and tariff policies may “turn the US into disaster,” a relatively positive development for Europe. To support his point about an illegal workforce, Ahmed noted that it accounts for 15% of the overall workforce in construction, 14% in agriculture and 8% in leisure industries. Extracting people from the economy would have an immediate impact on the economy whilst stopping immigrants at the border would have more long-term implications.

China: a controlled stabilisation

“We think that China will throw policy support against tariff risks… and be keen to reach some kind of deal.” Ahmed thinks that China is better prepared than Europe to cope with tariffs as they have reoriented their supply chains.

Despite industrial and export sectors challenged by tariff uncertainties, Ahmed sees some stabilisation--but from weak levels--in the property sector while an improvement in consumption will result in an economy that gradually recovers and even gains momentum.