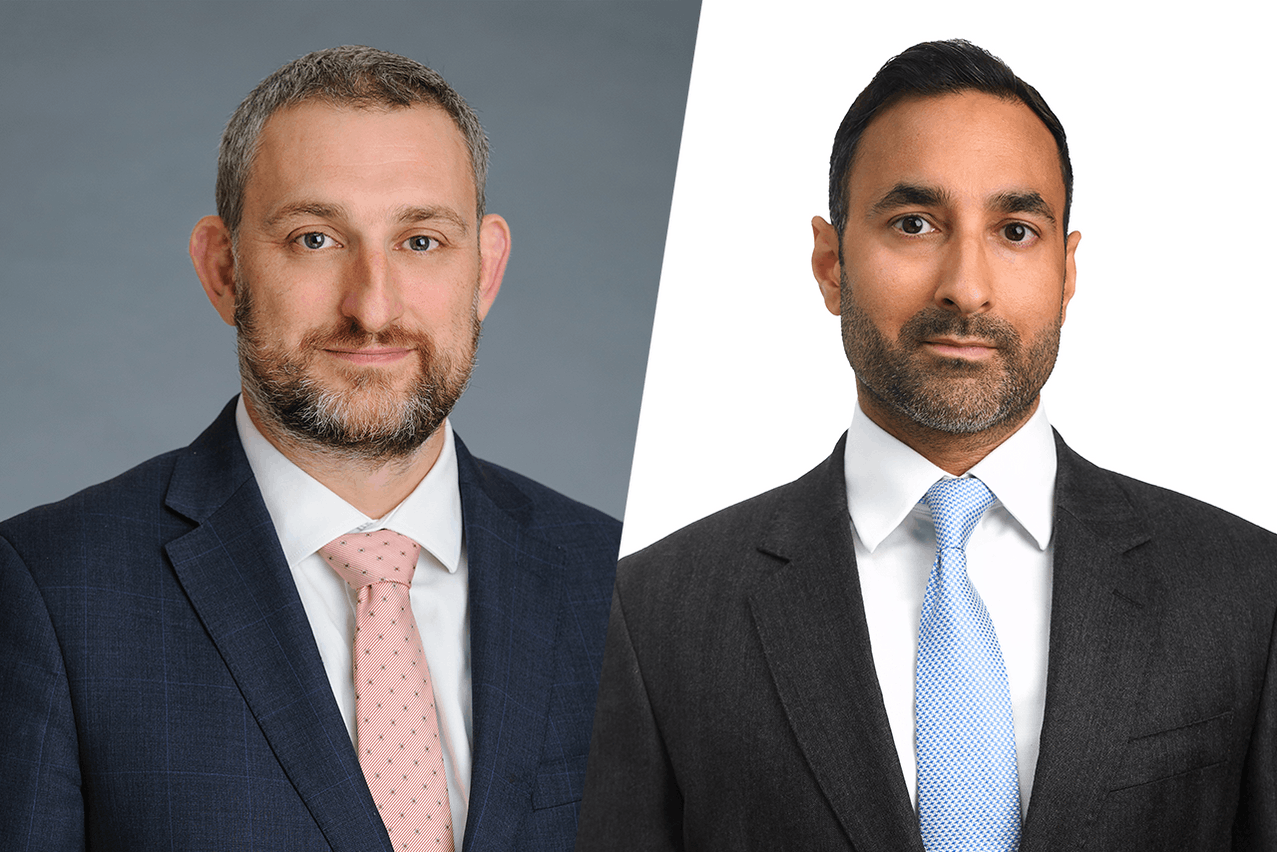

Fidelity International announced two new sustainable bond funds, domiciled in Luxembourg, as part of its commitment to sustainable investing, in a press release issued on Monday 6 May. The Fidelity Funds 2 - sustainable social bond fund and Fidelity Funds 2 - sustainable global corporate bond fund were introduced with London-based Kristian Atkinson and Shamil Gohil appointed as the lead managers, respectively.

The launch of these funds comes amidst global challenges in advancing the United Nations Sustainable Development Goals, stated Fidelity. The asset management firm underscored the urgency, noting a substantial $4trn annual funding gap between committed and required funds to achieve these goals. This funding shortfall, predominantly impacting social objectives, presents a significant opportunity for investors, emphasised Fidelity.

The sustainable social bond fund aims to deliver capital growth and income by investing in sustainable ventures. It allocates a minimum of 70% of its assets to investment-grade corporate debt securities globally, with at least 80% focused on socially oriented bonds. These bonds either support products or services contributing to targeted social UN SDGs or directly aid social themes through the use of proceeds bonds. Fidelity stated that the fund extends its focus to climate resilience and adaptation as a subtheme, emphasising the necessity of resilience-building against climate change impacts.

On the other hand, the sustainable global corporate bond fund seeks capital growth and income through sustainable investments and wider diversification. At least 70% of its assets are invested in investment-grade corporate debt securities worldwide, contributing to environmental or social objectives aligned with one or more UN SDGs. This approach offers a more diversified strategy compared to pure thematic funds, noted Fidelity.

Both funds are classified as under the Sustainable Finance Disclosure Regulation (SFDR).