With such an attribute, you will be entitled to invest in as many investment products as you can imagine, you will be advised to open investment accounts with banks, private banks, independent investment advisors, and broker dealers. The reality is, you will also most likely be asked to provide loans to friends and to friends’ friends.

At the end of the month, you are likely to receive investment statements from at least three banks, from your nine accounts, two different currencies and from four different geographies. You will have such a hard time to understand what your entire net worth is, that you will potentially accept a certain level of financial discrepancies and then you will move on.

In case you possess 10x, 100x, or 1,000x the abovementioned wealth, I am afraid to say that things will not change significantly. Even though you will most likely be supported by a Family Office (FO) - employing on average from three up to 15 people - your staff will be dealing with a much wider and interconnected investment-ecosystem that will incur two fundamental consequences: blurred vision and truncated communication.

According to , two-thirds of EU (European Union) Family Offices have up to ten banking relationships, 58 % of EU Family Offices have up to 10 investment managers and 64 % of European families cited improving communication with the Family Office as their top priority.

Family Offices PwC Luxembourg

Family Offices are meant to preserve wealth across generations - and the next generation is just a heartbeat away. Within the next decade, one-third of family offices globally will see the next generation taking control, hence the timing is ideal for Family Offices to reassess how suitable and digitally efficient their enterprise architecture is.

Principals, Heirs, and FO Staff should be minimally empowered to benefit from a (i) 360-degree clear view about their global investment portfolio, at the time they want and wherever they are; and (ii) professionally independent data quality curation.

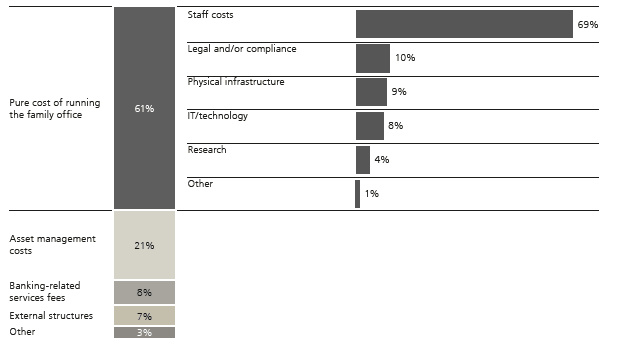

Family Offices’ cost-management approach is an added element that requires a profound shift, knowing that technology and automation is there to offer significant economy of scale for Family Offices from any size, shape and form. Although on average, EU Family Offices internal operating costs range from 60bps to 70bps, there are concrete cases of FOs operating at a much lower band, indicating that the right balance of insource vs outsource plus digital can make an enormous difference.

At PwC we care about legacy, and we are committed to providing solutions to the most pressing issues, and this is absolutely the case when we provide our services to Family Offices.

Our ambition with the new PwC Wealth Compass service is straightforward: we want you to regain control of your portfolio and manage your personal wealth more effectively with technology that meets you where you are - trusted and with end-to-end support- that helps you make decisions with speed and confidence.

Want to know more?