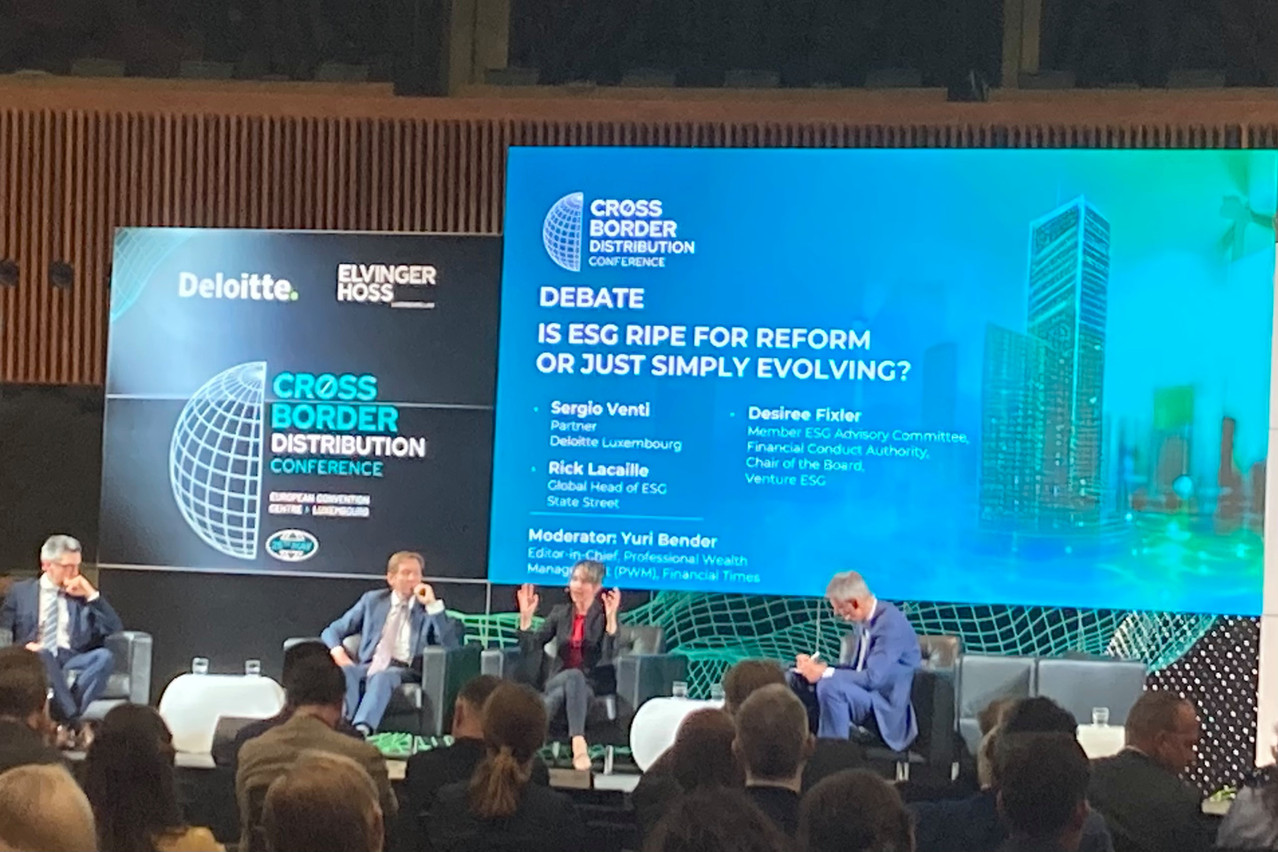

Deloitte and Elvinger Hoss Prussen co-organised, with the support of the Financial Times, the Cross-Border Distribution Conference on 25 May 2023 in Kirchberg, which concluded with a panel on ESG reform and evolution. The panel featured Sergio Venti, a partner at Deloitte, Rick Lacaille, global head of ESG at State Street, and Desiree Fixler, chair of Venture ESG, and was moderated by the Financial Times’ editor-in-chief, professional wealth management Yuri Bender.

“There’s a huge amount of competition in the sector. Every financial centre says, ‘we will be the main hub for ESG,’” said Bender. Is this possible for Luxembourg?

There’s such a large amount of information--briefings, information published in multiple languages and disseminated in various countries--that “it takes a while to become the centre of excellence,” began Venti. The foundations are here, the ecosystem--made up of lawyers, auditors, management companies, the regulator--is here.

But things are still at the beginning, he added. “It’s a lot of responsibility to become the centre of excellence in the field,” said Venti. “I think it’s really about getting it right. The infrastructure is here, the ecosystem is here.” But it’s a “very challenging topic” that has a “wide impact” on the industry.

ESG is “enhanced due diligence”

What about mis-selling and the politicisation of the ESG label? asked Bender. Would it be helpful to simply stop using the term altogether?

“Absolutely,” declared Fixler. “We will stop using it. It’s served its purpose. We needed it, we needed to draw attention to a rapidly changing world. I think most folks in finance accept the downside of climate change, but also the upside, you know, tremendous opportunities to invest in a new, clean economy.”

“ESG, for the most part, is just enhanced due diligence. It’s risk management. We don’t need to use these acronyms anymore,” she said. Integrating ESG risk and opportunity factors will simply become “the investment process.”

“It’s a generational shift”

“Thirty years ago, it wasn’t called ESG. It was called SRI investing--socially responsible investing. It was somewhat of a niche preoccupation, championed by only a handful of players,” said Bender. Most were skeptical about the long-term efficacy and performance, he noted. “What have been the key moments for you in recent fund management history that has changed the perception about this way of looking at the world?”

“It’s very hard to find and prove statements and many things in finance. ESG is no exception, there was very short data sets, and so you could say it’s extremely challenging to prove,” answered Lacaille. “And therefore it’s natural to be somewhat skeptical, particularly in an environment where there is a very strong market for things related to ESG.”

For Lacaille, three things have changed: regulation, customers and investment teams. “People have become more attuned to making more sophisticated inquiries about what’s going on in the investment process.”

The investment teams themselves have changed, Lacaille said. “If you’re a chemicals analyst, or an analyst in basic materials 30 years ago, you wouldn’t have thought too much about transition risk,” he said. “In any mainstream asset manager now--basic materials analyst or chemicals analyst--they’ll be all over this like a rash. So it has become normalised as part of the investment process. I think that’s a huge change.”

“It’s a generational shift. And it’s ongoing,” he said.

Best method to prevent--or curtail--greenwashing?

Greenwashing and misleading investors about the nature of green investments have become an issue as well, noted the panellists, who cited raids on DWS and Deutsche Bank as examples. In the case of DWS, the entire c-suite resigned. “What is the best method to prevent--or at least curtail--this greenwashing?” asked Bender.

It’s important to recognise that this is “complicated and long-term stuff,” said Fixler. It’s not just something that can be accomplished in the short-term. “Two years ago, we had this irrational exuberance. And today, after a few enforcement actions, I think we’ve come down to Earth and we’re on a better pathway here to understand how complicated this is.”

“The most important aspect is just to recognise that when it comes to ESG disclosure, it has to be verifiable, evidence-based and accurate as finance disclosures,” said Fixler. “Sustainability is a core business adaptation.”

It must be part of the entire enterprise, from front office to operations, it must be provable to investors, and it will be key to have quality data.