The euro area is expected to see a cumulative 75 basis points rate cut by April 2025, according to a recent Paperjam poll of economists. With a broadly optimistic consensus, they predict the European Central Bank will continue cutting rates by 25 bps at each of its next three policy-setting meetings, extending this trend into early 2025--barring any unexpected geopolitical shocks.

According to the poll, seven out of eight economists predict a 90% or higher probability that the ECB’s governing council will announce a 25 basis point rate cut at its first monetary policy meeting of the year on Thursday 30 January 2025. This would also mark the fourth consecutive rate reduction.

Expectations

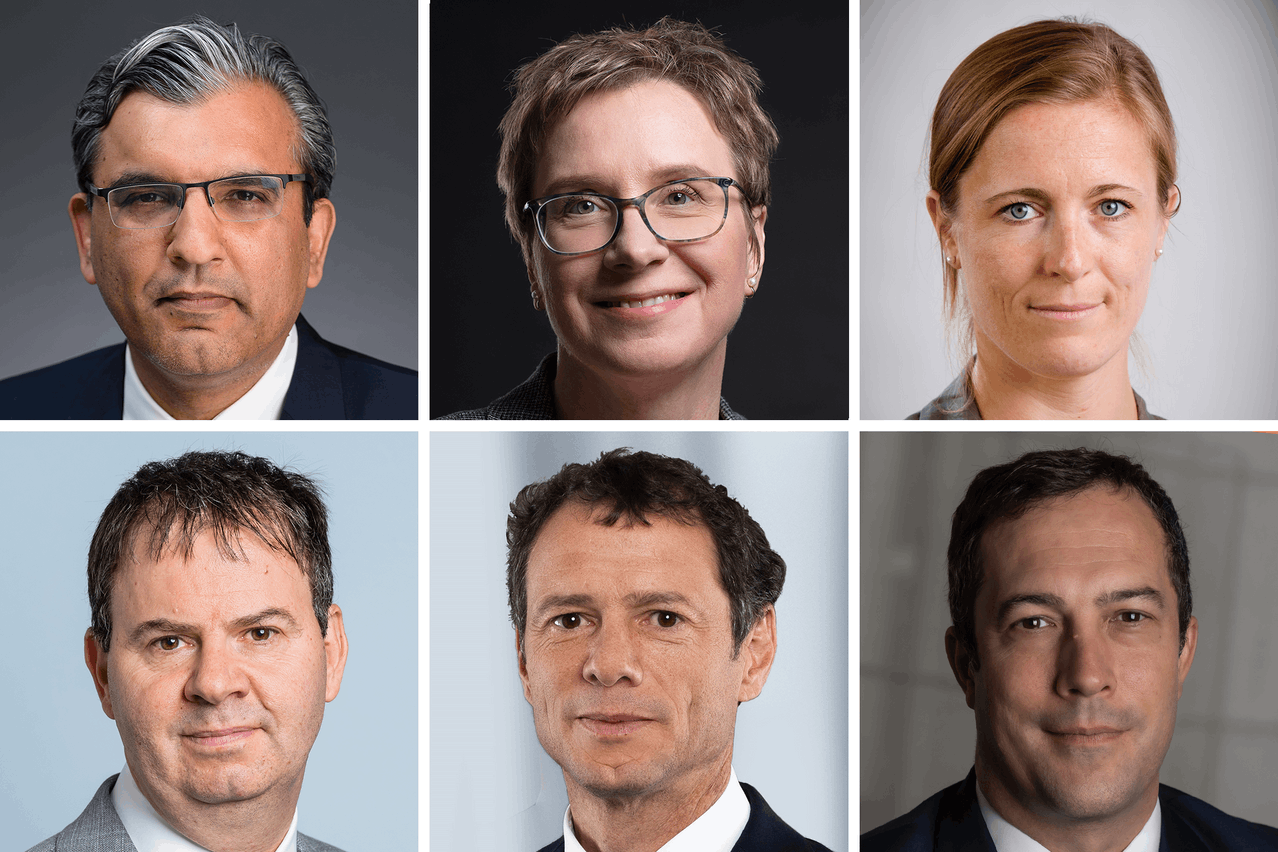

“The ECB will cut its key interest rates again by 25 basis points. There is no doubt about that,” said Volker Schmidt, portfolio manager at Ethenea. He went on to emphasise the central bank’s strong confidence that inflation will reach the 2% target in the first half of 2025, noting that with the target in sight, the focus now shifts to how far rate cuts will go. He added that ECB president Christine Lagarde has “put a target of 1.75% to 2.5% into play in December [2024]. We agree and expect the deposit rate will approach the lower end of the guidance already in the second quarter of 2025.” The ECB’s current interest rates are 3.00% for the deposit facility, 3.15% for the main refinancing operations and 3.40% for the marginal lending facility.

Paul Jackson, global head of asset allocation research at Invesco, concurred, “I think the direction of rates is still downward, the only question being the timing.” He expects the next rate cut to come in March 2025, although January remains a possibility. He further suggested, “An April cut would then be in the balance, more likely if rates are cut in January rather than March.”

Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International, said, “We continue to think that the ECB will cut rates by 25bps at each meeting until reaching 2%, followed by further gradual cuts into accommodative territory.” He also pointed out that tariff risks and trade wars are significant uncertainties for 2025, and that weak growth continues to drive the ECB towards easing.

“In contrast to the US Federal Reserve, the [euro area] economic and inflationary environment allows the ECB to cut the deposit rate by a further 25bps to 2.75% in January,” reasoned Ulrike Kastens, senior economist at DWS. She added that the ECB’s communications will remain focused on “data dependency,” given the high political uncertainty and that further rate cuts are expected, with the deposit rate likely reaching 2.0% by June 2025.

Eurozone economist at Axa Investment Managers, Hugo Le Damany, argued that “with a deposit rate at 3%, the ECB is still in restrictive territory.” He noted that weak economic and macro data provides no reason to delay further rate cuts and expects back-to-back reductions at each meeting, bringing the rate to 2% by June 2025. He added that, with growth below potential and inflation stabilising below 2%, the ECB will likely continue its cuts, reaching 1.5% by the end of 2025.

Michael Krautzberger, global chief investment officer of fixed income at Allianz Global Investors, highlighted that “core Eurozone economies are facing both cyclical and structural headwinds,” with trade uncertainty and potential US tariffs adding to the risks. He emphasised that the ECB’s rate-cutting path is clear in the near term, with rate cuts already priced in for the coming months. On euro area inflation, he added that the “broad disinflation narrative remains intact.”

Evelyn Herrmann, Europe economist at Bank of America, remarked, “We expect a 25bps cut in policy rates, and a reiteration of the (new) guidance from December.” She added that the next two cuts seem almost certain, though the trajectory beyond that will depend on inflation data.

Axel Botte, head of markets strategy at Ostrum Asset Management, said, “The ECB has room to cut rates towards a more neutral stance, and the central bank will continue cutting at a steady pace of 25bps until April.” He also noted that the ECB will act preemptively to protect the euro area from potential tariff hikes under the Trump administration.

Kevin Thozet, member of the investment committee at Carmignac, commented, “Assuming the economic environment remains as tepid as it currently is, the ECB is expected to bring policy rates towards a neutral level of 2% by the summer.” He also highlighted that while two consecutive 25bps cuts are almost a certainty, the pace may slow thereafter.