The European Central Bank is expected to reduce key interest rates in the Eurozone by 25 basis points for the fourth and final time this year, despite inflationary shoots beginning to appear in the region. This decision is anticipated during the ECB’s rate-setting governing council meeting in Frankfurt this week. While inflationary pressures are starting to emerge, the ECB is likely to continue its accommodative stance given the ongoing weakness in Eurozone economic growth. Barring any major geopolitical surprises, a group of 12 economists surveyed by Paperjam also predict that the rate-cutting trend will extend into the ECB’s meetings in January and March 2025.

Eurostat, the EU’s statistical office, estimated that the euro area’s annual inflation rate rose to 2.3% in November 2024, up from 2.0% in October and 1.7% in September. Meanwhile, Statec, Luxembourg’s statistical bureau, a contrasting trend in the country, with consumer prices continuing to decline, as inflation dropped to 0.8% in November.

Expectations

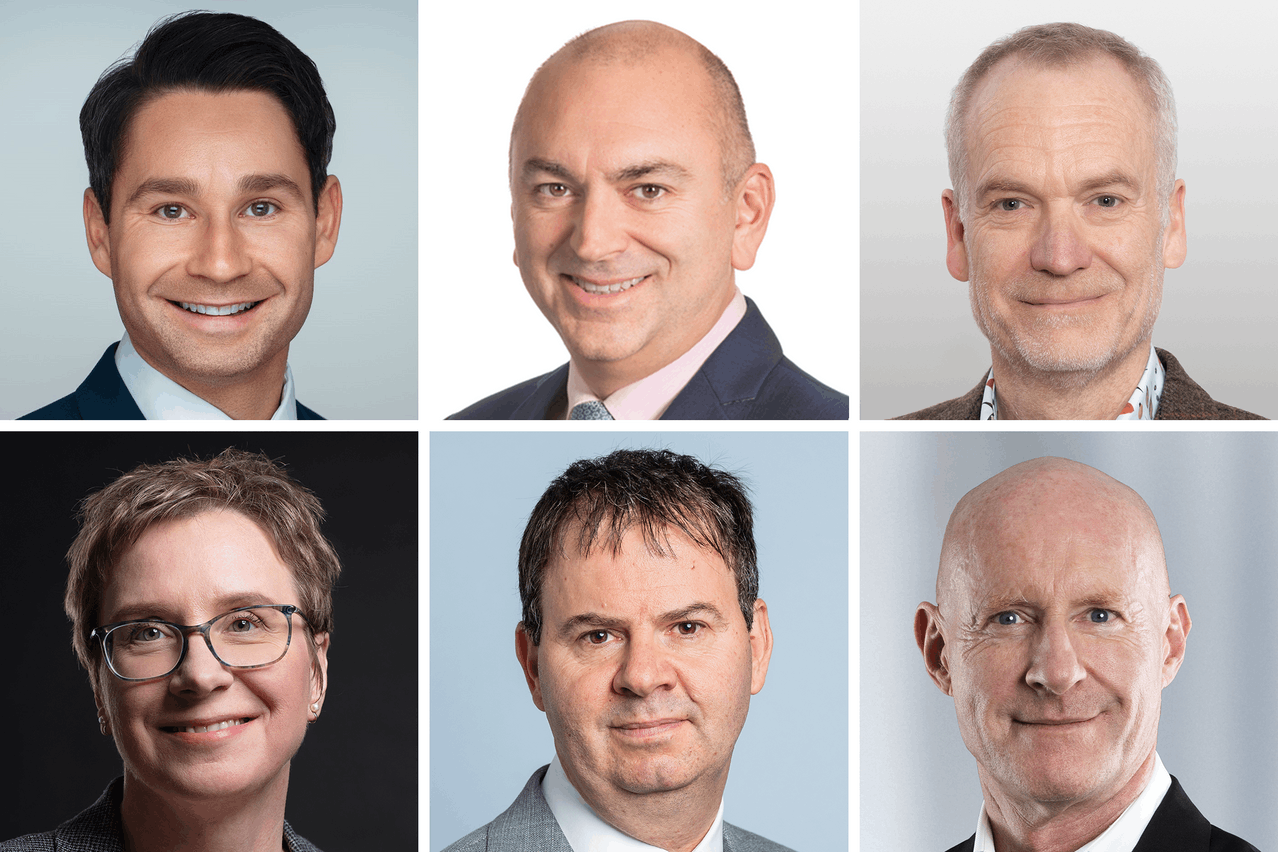

Michael Krautzberger, global chief investment officer of fixed income at Allianz Global Investors, noted that economic growth in the Eurozone had continued to disappoint since the last ECB meeting in . He highlighted concerns over future tariff risks stemming from the outcome of the US presidential election, which could further complicate growth prospects in 2025. Krautzberger expressed doubts that the ECB would accelerate its policy pace until there is greater clarity on future US trade policies.

Francois Cabau, senior eurozone economist at Axa Investment Managers, projected a gradual path for rate cuts, with the deposit rate expected to reach 1.5% by the end of 2025. This forecast is based on expectations of modest growth in the Eurozone, with GDP growth of 1.0% in 2025 and 1.3% in 2026. Cabau warned of downside risks, particularly from both domestic and external factors, which could affect the pace of the rate cuts. He also forecast that inflation would undershoot the ECB’s 2% target, averaging 1.9% in 2025 and 1.7% in 2026. This scenario would likely lead the ECB to adopt a more accommodative stance earlier than currently expected.

Ruben Segura-Cayuela, head of Europe economics research at Bank of America, said that the ECB is likely to reduce rates by 25bps but would avoid larger cuts. He indicated that the shift in ECB discussions from a 50bps cut to more measured language reflected the difficulty in keeping inflation near the 2% target in the medium term. Segura-Cayuela anticipated that future ECB communications would signal a gradual reduction in policy restrictions without committing to a specific rate path.

Kevin Thozet, a member of the investment committee at Carmignac, acknowledged that while markets are anticipating a 25bps cut, the likelihood of a 50bps cut appears slim due to stronger-than-expected growth in Q3 2024 and a hawkish shift in the US Federal Reserve’s monetary policy stance. He suggested that the ECB may begin to shift from a “meeting-by-meeting” approach towards a “willingness to reach neutral rates” in its forward guidance, depending on the unfolding economic landscape.

David Chappell, senior fund manager of fixed income at Columbia Threadneedle Investments, added that while the ECB is expected to remain active in the coming months, a larger-than-usual rate cut seems unlikely. He noted that the pace of “normalization” could accelerate once US trade policies become clearer in the spring, particularly in light of uncertainties surrounding the impact of the US presidential election on global trade.

Ulrike Kastens, senior economist at DWS, indicated that despite the deteriorating economic outlook and inflation being somewhat better than expected, she did not anticipate any urgency for larger rate cuts. She pointed out that the ECB’s data-dependent, meeting-by-meeting approach would likely continue, with the growth outlook possibly revised downward. Inflation is expected to move closer to the ECB’s target of 2% in the coming years, which could open the door for further rate cuts into 2025.

Luca Pesarini, chief investment officer at Ethenea, echoed similar views, forecasting a 25bps rate cut for the ECB’s next meeting on Thursday. However, he raised doubts about the possibility of a larger 50bps cut, citing the current strength of the labour market, with the Eurozone unemployment rate at a historic low of 6.3% and core inflation remaining at 2.7%, which is far from the ECB’s 2% target.

Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International, also projected a series of 25bps cuts, pushing the ECB towards neutral territory at a 2% deposit rate. However, he noted that the ECB’s ability to deliver large cuts would be constrained by concerns over wage growth and services inflation, which continue to persist in the region. He further suggested that the ECB might adopt a more gradual pace of easing into accommodative territory once the neutral rate is reached.

Alexander Bell, fixed income portfolio manager at Indosuez Wealth Management, forecast a 25bps rate cut for each of the ECB’s meetings in December, January and March, eventually halting at a 2% deposit rate by mid-2025. He projected that the Eurozone would experience subpar growth of 0.8% in 2025 but avoid a recession. Bell highlighted that inflation would gradually return to the ECB’s 2% target, though services inflation remained a key risk.

Paul Jackson, global head of asset allocation research at Invesco, noted that the Eurozone economy had lost momentum in the second half of 2024, with inflation now ranging between 2% and 3%. Jackson speculated that the ECB would likely implement a 25bps cut in December but could pause its easing cycle in January before resuming in March, depending on the economic data.

Andrzej Szczepaniak, senior European economist at Nomura, believed that while data from October and November 2024 had been volatile, the overall trend supported a 25bps rate cut. He pointed out that despite weak purchasing managers’ indices, stronger-than-expected official data indicated the ECB would not rush to implement large cuts. Szczepaniak also noted that rising concerns over US tariffs and slower momentum in services inflation supported a more cautious approach from the ECB.

Axel Botte, head of markets strategy at Ostrum Asset Management, predicted that the ECB would gradually cut rates to 2.25% by mid-2025. However, he suggested that inflation risks, particularly in relation to services inflation, would prevent the ECB from cutting significantly below 2%. Botte emphasised that the ECB would also need to monitor US trade policies, which could influence its decisions, especially if new tariffs are imposed.

The ECB’s governing council will convene on Thursday 12 December 2024 to decide on the key interest rates for the Eurozone.