This is 2.5 times better than in 2016 ($1.8 billion), which had already been seen as the year of recovery.

In 2015, the steel group had to announce a record loss of $7.9 billion following, among other things, the depreciation of assets in the mining sector. According to Paperjam, it was also said to have suffered from export dumping by China to sell off its surpluses.

At the time, its debt had exploded to more than $15 billion and imposed a capital increase of $3 billion to reduce it. At the end of the 2017 financial year, it was reduced to 10.1 billion against 11.1 billion at the end of 2016.

The 2017 turnover reached $68.6 billion against 56.7 billion a year earlier (+21%).

But the steel giant still wants to continue efforts to reduce its debt. In a statement released on 31 January, the target is to reach $6 billion of net debt.

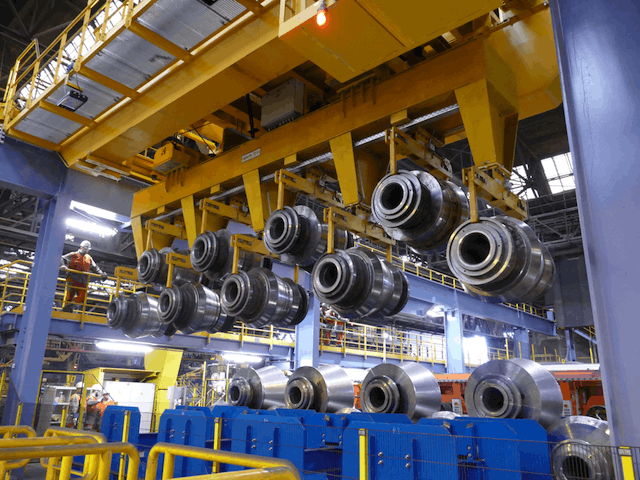

For 2018, ArcelorMittal estimates that “the demand environment remains positive” and expects investment spending to rise to $3.8 billion ($2.8 billion last year). They will include a hot rolling mill project in Mexico and possible expenses for Ilva, the Italian steelmaker acquired in mid-2017 in consortium with the Italian group Marcegaglia and the bank Intesa Sanpaolo.

“The market conditions remain favourable, but our sector must continue to meet the double challenge of overcapacity and unfair trade practices,” said the CEO Lakshmi Mittal in the statement.