Apex Group, a global financial services provider, announced in a on 4 October 2023, that it has completed the acquisition of the business outsourcing division of MJ Hudson Plc after receiving all necessary regulatory approvals. The acquired division encompasses management company operations in Luxembourg and Ireland, as well as Channel Islands fiduciary and fund administration and investment advisory services.

In Luxembourg, MJ Hudson’s manco unit will integrate into Apex Group’s existing FundRock brand. This move aims to further solidify FundRock’s standing as the largest manco in Luxembourg. According to the company’s , FundRock currently serves more than 1,200 funds, with total assets under management amounting to €234bn across 12 countries.

The Irish manco business, which will maintain its operation under the Bridge Fund Management brand, offers third-party management company and fund governance services to both Irish-domiciled Ucits and AIFs. Bridge Fund Management, with assets under management exceeding €76bn, is one of the largest management companies in the Irish market.

In addition to the Luxembourg and Irish markets, Apex has also extended its reach in the Channel Islands. The acquisition includes MJ Hudson’s fiduciary and fund administration business, which caters to approximately 200 clients in Jersey and Guernsey. These clients range from funds and corporates to family offices.

Beyond fiduciary and administration services, Apex has incorporated MJ Hudson’s non-regulated investment advisory business into its service offering. This new addition enhances Apex’s suite of advisory support services, encompassing aspects such as asset allocation, portfolio construction, manager selection, due diligence assistance and analytics, stated the press release.

Previously, Apex Group had also successfully closed the acquisition of MJ Hudson’s unregulated data and analytics businesses. The quantitative solutions business has since been rebranded as Clarus Risk.

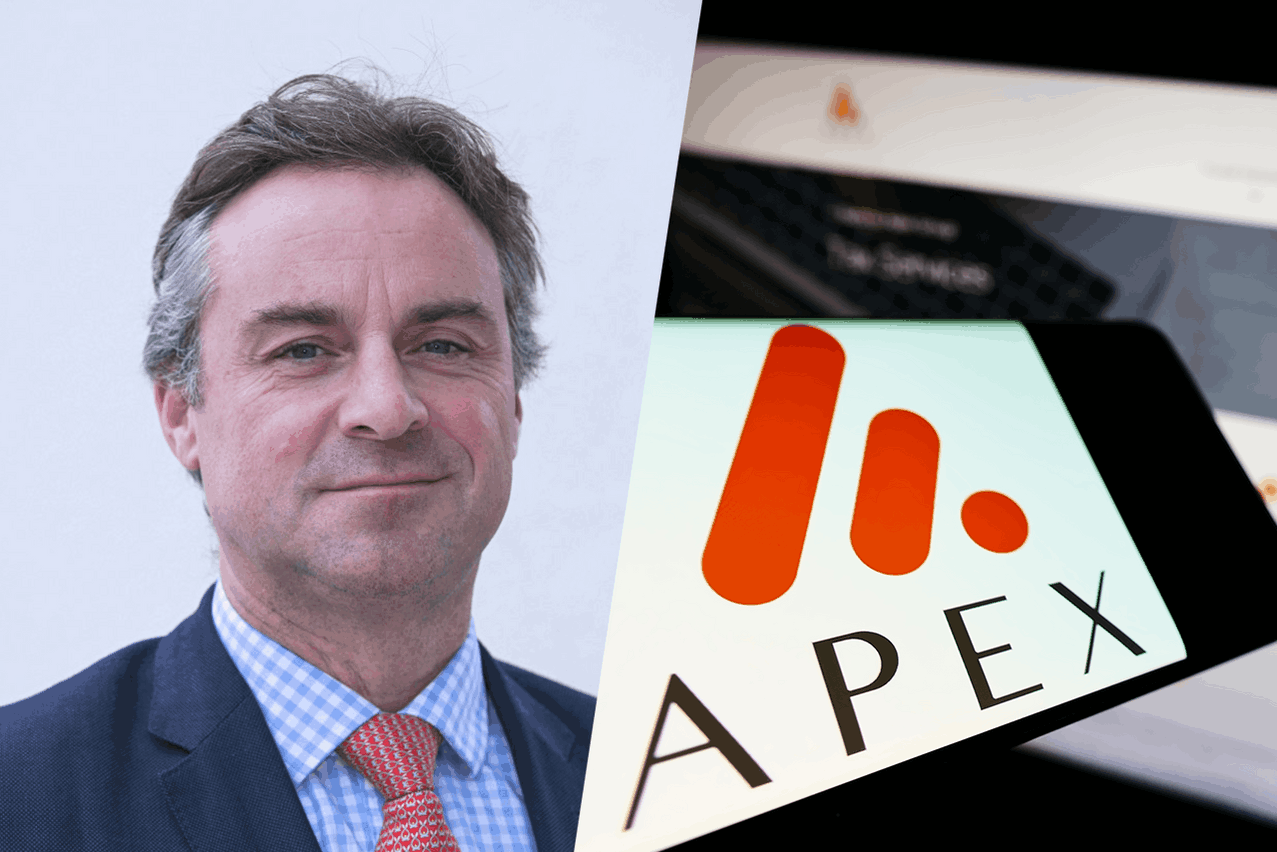

Peter Hughes, founder and chief executive officer of Apex Group, stated that the acquisition allows MJ Hudson’s clients to benefit from a single relationship with a global service partner. Hughes emphasised the company’s ability to offer significant substance and technology to meet client demands across all major European investment jurisdictions.

Advising on the acquisition, Apex Group received counsel from Rothschild & Co and Kirkland & Ellis International LLP, while MJ Hudson was advised by Alvarez & Marsal and Walker Morris.