Fund services giant Apex Group has launched its adoption of blockchain technology, aiming to broaden access to global private market funds and increase the efficiency of their distribution and administration. As the grand duchy’s first transfer agent and fund service provider to administer regulated securities using blockchain, the firm has opened opportunities for a more diverse group of qualified investors to engage with these funds, Apex in a press release on Wednesday.

Working with the investment manager Hamilton Lane and the Swiss digital asset banking group Sygnum Bank, Apex Group introduced a digital share class for the Hamilton Lane GPA fund, along with a distributed ledger technology registry, aimed at consolidating fund administration functions that were previously managed separately. The introduction of tokenisation and a DLT registry has streamlined the distribution and administration of the fund, said Apex.

Apex falls under the regulation of the Luxembourg Financial Sector Supervisory Commission (CSSF), meaning the firm manages investor onboarding, including anti-money laundering and know your customer protocols. Additionally, Apex oversees subscription, administration and transfer agency duties for both traditional and digital share classes. The Apex Group plans to extend this regulatory approach to all its asset management services, aiming to boost product sales.

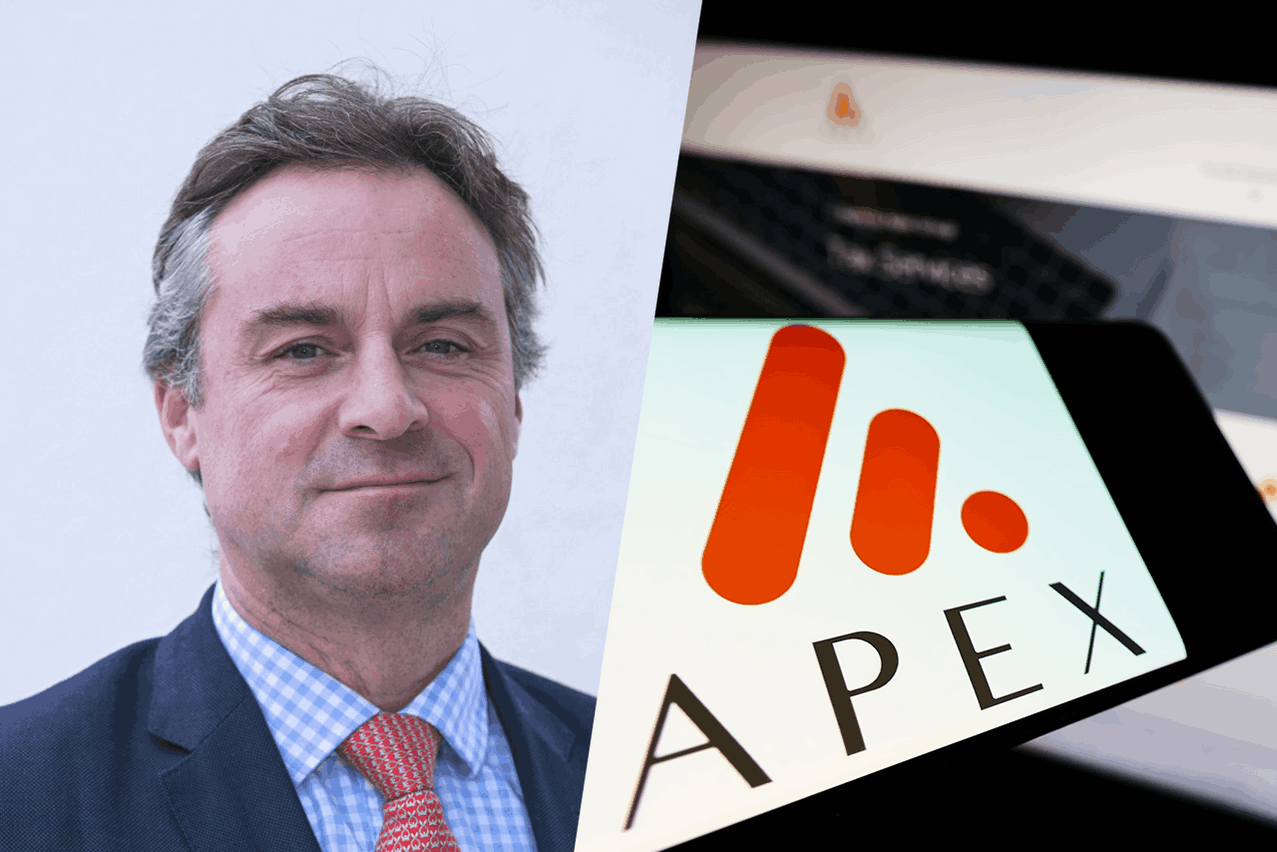

Peter Hughes, chief executive officer of Apex Group, highlighted the transformative potential of this initiative, stating in the company’s announcement that it represents a significant disruption to conventional practices within the financial services industry. By leveraging technology, Hughes asserted that Apex Group is at the forefront of fostering positive change across the sector.

Bruce Jackson, chief of digital asset funds and business at Apex Group, shared insights into the company’s ambitions to enhance the accessibility of alternative asset strategies for distributors and wealth managers. “We will continue to perfect our Framework Operating Model for the distribution of alternative asset funds using blockchain as the subscription, onboarding, operating, administration, and transfer agency platform”, commented Jackson.