Easter is the ideal season: buy a shoulder of lamb, cut it into cubes; add a couple of green olives, a few carrots; some thyme, bay leaf or oregano; add a spoonful of brown sugar or two; a glass of water or two; and simmer at 180 degrees in the airfryer for just over a quarter of an hour. The recipe is unstoppable, capable of propelling the average pasta-boiler to the rank of budding chef.

However, in September 2010, when Philips launched what would become a revolution--years later--in the world of household appliances, the reception was cool. Its first airfryer, presented at the Internationale Funkausstellung Berlin trade fair, used “Rapid Air”, a technology that combines rapidly circulating hot air with a heating element to cook food with virtually no oil. It took a long time to win over the hearts (and stomachs) of consumers. But 15 years later, the number of models has multiplied and European manufacturers such as France’s Moulinex and Britain’s Russell Hobbs have jumped on the bandwagon. Until the arrival of the American Ninja, which has become the market leader with its multitude of models, from the most compact to the most imposing. According to Market Research Future, the size of the air fryer market was $1.21bn in 2023 and is expected to reach $2.2bn by 2032.

The trend has obviously not escaped Luxembourg. In the country’s shops--whether specialist chains or large and medium-sized supermarkets--it’s impossible not to find one. At Mediamarkt, for example, there’s a dedicated section displaying around ten models. “It’s a two-stage trend. First, over five years ago, with the first oil-free fryers. At the time, the sales argument was mainly that of healthy cooking, with a product that appealed mainly to people looking to eat less fat because of cholesterol or for health reasons, for example,” recalls Maxime Dupont, a sales advisor specialising in household electrical appliances at Mediamarkt. Hifi International’s product offer director, Alexandre Hatterer, had virtually the same words to describe the trend, though the two men--of course--had not consulted with each other beforehand. Today, say the two professionals, customers are more attracted by the versatility of the appliance, combining oven or grill cooking, roasting, steaming features and more...

In fact, airfryer users can no longer be pigeonholed. “Initially, the clientele was quite young because it was they who arrived via social networks. But today, we have all kinds of buyer profiles for these devices. It really has become a mainstream product,” notes Hifi International’s Hatterer.

And it was this promotion carried out by influencers on the networks that really triggered the trend, believes Hifi International’s product offering director. “We really sensed the start of this trend in 2023. In reality, it started to shift a little earlier because--my goodness--it’s a very old product, but it wasn’t any more successful than that at the start,” he adds.

4,000 airfryers sold last year at Hifi international

The sales arguments are many. The appliance is supposed to satisfy a multitude of demands from the father of a family in need of inspiration, the mother of a family attached to a less greasy kitchen, the student who lives in a small studio that doesn’t allow him to accumulate appliances or even the cross-border commuter who comes home late and doesn’t want to waste too much time cooking!

Such aspirations have prompted European manufacturers, following in the footsteps of the American Ninja, to develop their appliances and incorporate a greater number of functions. “As well as versatility, which has become a key selling point, the designs are also becoming increasingly sophisticated, as this is the type of appliance that stays on the kitchen worktop,” points out Dupont.

But the retailers that sell them--such as Mediamarkt or Hifi International--don’t have an exhaustive range and prefer to select those that will best suit their customers. “There is a plethora of them, in all shapes and colours. As offer selectors, we try to choose the right products. Because each product corresponds to a need, depending on the size, capacity, functionality, price, etc. One of the strengths of this product is that it is easy to use. One of the strengths of this product is that it has even encouraged some people who didn't cook to start cooking,” explains Hifi International’s product offer manager.

In the chain’s sales outlets, around 4,000 appliances of this type were sold last year. “We sell around 300 a month, with peaks in the last few months of the year for example,” says Hatterer.

A range of prices

But among the multitude of products, it’s not always easy for consumers to find their way around. “The first thing to look at is the number of people you’re planning to cook for. Some appliances are very small and compact, with just one drawer. Others are bigger and can cook two things independently. You also need to think about how you intend to use it: will it become the main cooking appliance or will it be used more occasionally?” asks the sales advisor at Mediamarkt, where around five appliances of this type are sold every week, excluding specific promotional periods such as Black Friday.

As far as prices are concerned, “a crucial factor in the intention to buy,” stresses Hatterer, they also vary according to the features detailed above, the models and the brands. They range from around €70 for the most basic model to over €300 for the one with the most features. For classic appliances, those from European manufacturers are a little cheaper than those from the Ninja brand, which are a little pricier but offer more features, such as the latest models combining airfryer cooking with a pizza oven or plancha, for example.

Mediamarkt, for example, doesn’t necessarily run promotions on these products because they’re trendy. The company instead opts for a stable pricing policy. “We still find a few models on special offer because they are appliances with a few parts left or exhibition models that we prefer to sell for a little less rather than keep unnecessarily in stock,” explains Dupont.

But how do you explain these price disparities from one chain to another? “The right price doesn’t mean the cheapest price. At Hifi International, we also offer real advice with local shops. All products must be in stock. You can always find something cheaper, but it depends on how much confidence you have in the purchasing channel,” says Hatterer. Generally speaking, the manufacturer gives the retailer a recommended selling price. The seller is then free to set his own selling price. “Some retailers will buy a lot of stock in order to offer promotions on one brand, whilst the competitor will have the same strategy with another brand. But we monitor market prices. We also keep a close eye on the competition so that we can observe price trends. And then there are our own sales promotions, where we decide to give our customers the benefit of a lower market price to boost sales,” explains Hatterer. Sometimes it is the producer itself who decides to launch a promotional operation over a period, in one country but not in the neighbouring country.

Hifi International has even gone a step further and capitalised on the popularity of these appliances to offer an appliance under its own brand: Essentiel B. “These are products that are supposed to correspond to an essential use at a price that is still better placed than the three main players in the market, which are Ninja, Moulinex and Philips.”

Beyond the appliance itself, a whole ancillary market has developed, incorporating more and more cookbooks with adapted recipes and items such as compatible moulds for more elaborate recipes. And according to the two professionals, the market still has a bright future ahead of it. “There are still some good years ahead, with technologies continuing to advance. Once the equipment rate [around 50% at present, editor’s note] reaches a certain point, there will undoubtedly be a slowdown in sales volume, but then the replacement market will come along. What’s more, technology continues to advance. Today, new functions are being added, such as steam cooking. We’ll also be seeing more and more connectivity in these appliances, allowing them to be connected to their smartphones to personalise recipes, or remotely,” predicts Hatterer.

It is also to be expected that artificial intelligence will also find its way into these kitchen appliances. For example, the Chefmaker 2 model from Dreo presented at the last CES trade show in Las Vegas uses AI to convert traditional recipes into recipes adapted for this appliance. The concept of gamification will also be increasingly taken into account by manufacturers to offer products that meet customers’ needs and, above all, arouse their curiosity. We could, for example, imagine the addition of voice commands or even the possibility of integrating a virtual coach to help users get to grips with the device.

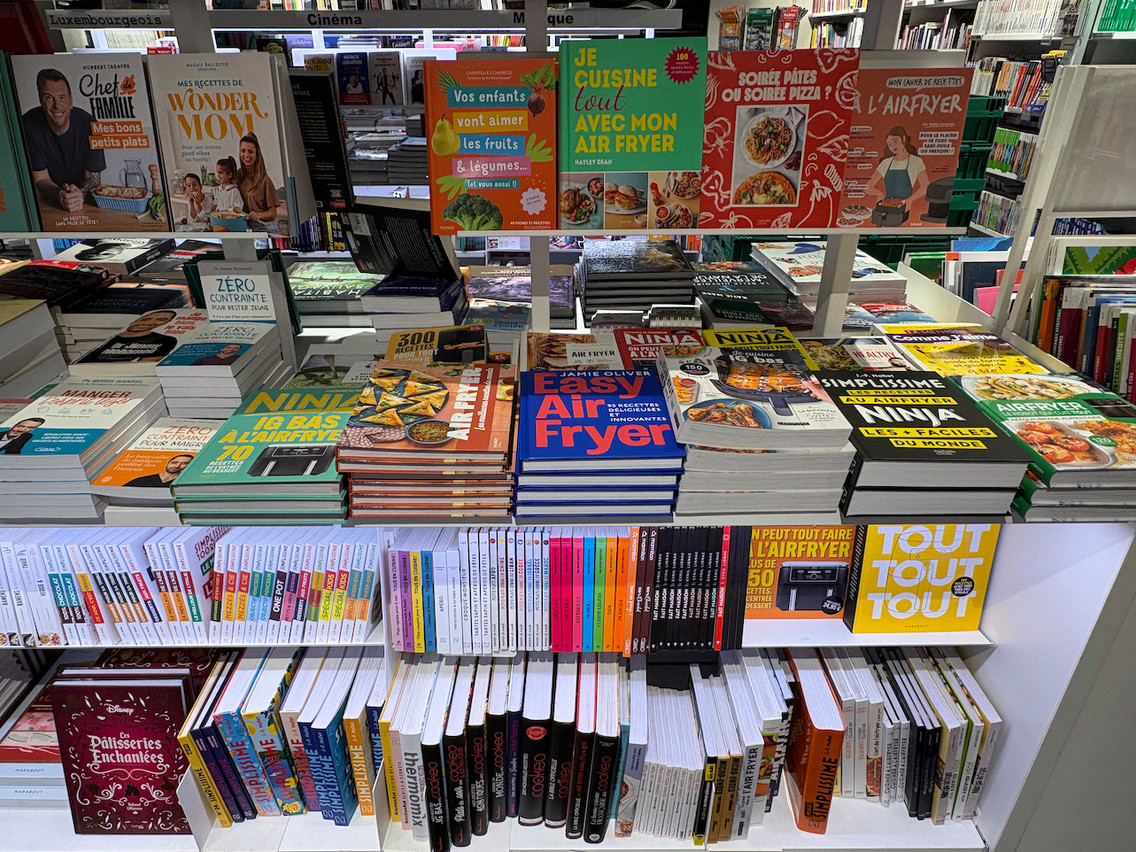

Forty or so books are also on offer at the Fnac in Hamilius. It’s a sign of the craze for these devices. Photo: Maison Moderne

The craze for airfryers is not only satisfying the stomachs of hurried cooks: more than 40 books are on offer at the Fnac in Hamilius--some of which are published by the manufacturers themselves--that cater to the need to find recipes, rather than user guides. And here again, you need to decode who knows how to talk about airfryers!

This article was originally published in .